MercoPress. South Atlantic News Agency

Brazil runs the risk of becoming highly dependent on natural-resources exports

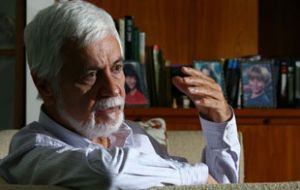

Economist Edmar Bacha was one of the architects of the Real Plan to stabilize the Brazilian economy

Economist Edmar Bacha was one of the architects of the Real Plan to stabilize the Brazilian economyA leading Brazilian economist Edmar Bacha, one of the architects behind the 1994 Plan Real to stabilize Latin America’s largest economy said the country was at risk of becoming entirely dependent on natural resources exports and urged greater savings to invest in diversification.

“I think the main challenge is that we may not know how to manage wealth generated from natural resources. Wealth that will be greater in the future when Brazil begins exploiting the very deep oil offshore”, said Bacha in an interview with O Estado de Sao Paulo published Sunday.

“We need to take the necessary measures so as not to fall into the ‘curse of natural resources’ suffered by countries such as Venezuela and Argentina when the discovery of raw materials created sudden wealth “that is not the result of previous work, of the accumulation of capital or the improvement of human resources” underlined economist Bacha.

The solution lies in “using this great opportunity of increasing raw materials revenue to augment the savings rate and invest not only in infrastructure, but also in the diversification of the economy and the improvement of education,” he said.

“Because in that way, at some time we will have a more solid economy that will not depend only on raw materials” economist Bacha said, adding that the keys to sustainable growth are “savings, technology and education”.

“We have serious problems. The quality of education in Brazil is terrible and we’re not a very innovative country. Also, the savings rate is very low, too low” Bacha said.

The economist then mentioned Chile and Norway as examples of good management of natural resources income surpluses. “Both countries created sovereign wealth funds that help contain overvaluation of their currencies while the returns are used to promote economic diversification”.

Prices of raw materials, although they can suffer temporary setbacks because of the developed countries’ slowdown will keep increasing because of demand from countries such as China and India that have become the “centre of the world” argued Bacha..

The extraordinary expansion of the Brazilian economy in recent years has been based mainly on raw materials’ exports that help accumulate international reserves but also appreciate the local currency and limit competitiveness.

Top Comments

Disclaimer & comment rules-

-

Read all commentsWith all the natural resources in all of South America and nearly 400 million people, Brazil and the rest of Latin America should be using those resources to become a powerhouse of wealth generation. Cut the government (and the corruption along with it), and free the people to make and grow things. South America has more natural resources than North America, but we continue to bow our heads and submit to the bankers, who strip us of all our value.

Jan 11th, 2012 - 03:07 pm 0The best thing the countries of South America could do for itself is to tell the Gringos and Britts to take a hike. South America should start its own central bank (but do not privatize it) and encourage competing currencies. That is, every country in South America should be willing to accept any South American currency as payment of debts, without having to go through the Bank for International Settlements (another Rothchild monopoly).

”South America should start its own central bank (but do not privatize it) and encourage competing currencies.”

Jan 11th, 2012 - 03:39 pm 0No they don't. Don't you learn from that Euro debacle, though the central bank there is a (hidden) private bank in the hands of the Germans. If your wish comes through, there will be no question that Brazil would control the bank, and that would lead to problems with it's spanish speaker nations and do you think Brazilians would bailout failed nations? You know the answer (No). Anyway, it's all theory now because the idea has be shredded, because they've seen the bad side in Europe what can happen with a single currency. It doesn't work in Latin America, also because of culture differences. Besides, most banks in South America are government entities though they are a member of the BIS.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!