MercoPress. South Atlantic News Agency

Fitch downgrades Repsol rating to BBB- on fears of YPF seizure impact

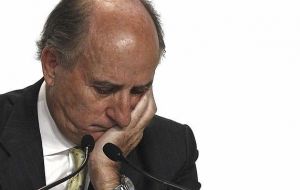

CEO Brufau has yet to see how Repsol is to recover compensation from YPF (Photo Efe)

CEO Brufau has yet to see how Repsol is to recover compensation from YPF (Photo Efe) Repsol, the Spanish oil producer whose Argentine unit YPF was nationalized in April, was cut to the lowest investment grade by Fitch Ratings, the first downgrade since reducing dividends to shore up its finances.

Fitch reduced Repsol’s credit rating one level to BBB-, the first reduction by any agency since Repsol announced a strategic review on May 29. The outlook for the rating is negative, Fitch said in a statement on Friday.

“The negative outlook is mainly driven by the uncertainty surrounding the execution of the strategic plan at this stage and weakness in the Spanish macroeconomic environment,” Fitch said. “After implementing its financial action plan, Repsol’s ratings could be further downgraded to non-investment grade” if the company doesn’t reduce its debt enough.

Spain’s biggest oil producer last month lowered its dividend payout ratio to 40% to 55% of this year’s profits on May 29. It also plans to bolster production from its remaining assets outside of Argentina by 7% a year through 2016 and add new reserves covering 120% of the oil pumped.

Chairman Antonio Brufau met investors last month to explain his plans to reshape the Madrid-based company after Argentine President Cristina Fernandez nationalized its YPF unit, her country’s largest oil company. Analysts’ concerns have focused on how Repsol will finance its expansion after the seizure. Standard & Poor’s reduced the credit rating to BBB- in April, saying it may cut the company’s debt one more step to junk unless borrowings are lowered.

Fitch assumes that Repsol will not receive any cash compensation from the Argentine government in the short to medium term and will not recover any of the cash lent to The Petersen Group to purchase 25% of YPF capital several years ago.

Repsol shares have declined 46% this year. YPF contributed 26% of 2011 operating profit and had 45% of Repsol 2.2 billion barrels of proven reserves.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsthe dye is cast

Jun 08th, 2012 - 10:51 pm 0a warning to all forieng investers in CFKS gravy train.

@1 Excuse me. It's a “die”. The singular of “dice”.

Jun 09th, 2012 - 02:49 pm 0thanks

Jun 09th, 2012 - 05:18 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!