MercoPress. South Atlantic News Agency

Argentina will have to post 10m plus bond in Ghana to liberate ARA ‘Libertad’

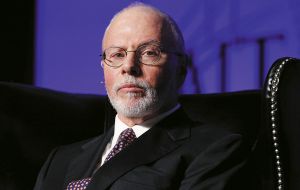

Paul Singer, the multimillionaire founder and CEO of Elliot Management fund

Paul Singer, the multimillionaire founder and CEO of Elliot Management fund Argentina will have to come up with 10 million dollars or more as a bond to liberate the flagship of its navy, “Libertad” retained in the Ghanaian port of Tema, following on the request from a US hedge fund.

Earlier this week the Superior Court of Judicature granted NML Capital Limited, a commercial creditor of Argentina, an injunction and interim preservation order against the sailing ship ARA Libertad, which arrived Monday at Tema port, reports the Accra press.

The order requires the Libertad to remain at Tema pending hearings on the enforcement in Ghana of judgments against Argentina issued by the United States District Court for the Southern District of New York, supported by similar judgments in London.

“Argentina may obtain release of the ship, however, by posting a bond with the High Court in Accra”, point out the local press mentioning the possible 10plus million dollars bond.

According to the request from NML Capital Ltd., “Argentina’s status as an international scofflaw has been well documented. International creditors have won more than 100 court judgments against the Argentina government, but Argentina has refused to honour any of these judgments and has repudiated bonds which it issued in good faith”.

A New York judge has characterized Argentina’s refusal to pay its debts as an “absolute steadfast refusal to honour its lawful debts,” and that the government is “defying deliberately, intentionally, and continually.”

Argentina’s treatment of creditors and debts also extends to international financial institutions and has “repeatedly ignored judgments issued by the World Bank’s arbitral body, the International Centre for the Settlement of Investment Disputes (ICSID). In May 2012, the Spanish oil company Repsol filed the 50th ICSID case against Argentina”.

Among G-20 countries, “Argentina accounts for 84% of pending cases at ICSID. It has consistently disregarded the rule of law”.

The Accra press also underlines that in stark contrast, while Ghana has attained an exemplary ranking among nations of Africa on the Centre for Financial Stability’s Rule of Law Index, “Argentina ranks near the bottom, because of its ongoing defiance of international covenants”.

“Although a sovereign government is involved, such enforcement in Ghana of judgments from courts in the United States and England is commercial and routine”.

Libertad is a “tall ship” used for training Argentina’s future navy officers and Tema is one of more than a dozen ports where she is scheduled to call for training and supplies in its six-month circumnavigation of the Atlantic.

NML is a subsidiary of Elliott Management, a New York based investment fund engaged in the management of investments on behalf of pension funds, university endowments and other institutions and individuals.

Paul Singer who is founder and CEO of Elliott Capital Management fund bought Argentine debt at reduced prices during the country's economic crisis a decade ago, and now values those unpaid debts at more than 1.6 billion dollars.

From Buenos Aires Argentine diplomats have said publicly that they are working with Ghana to clear up the problem.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsThat's cheap. They should have to pay what they owe.

Oct 04th, 2012 - 09:02 pm 0Among G-20 countries, “Argentina accounts for 84% of pending cases at ICSID. It has consistently disregarded the rule of law”.

Oct 04th, 2012 - 09:09 pm 0OUCH and they've nicked you're ship, crikey things aren't looking good, I'll buy it just to piss you off, loads of fire wood.

Oh joy!

Oct 04th, 2012 - 09:47 pm 0At last AG has come against an honest country that is quite prepared to enforce a legal document unlike her friends in LatAm, including I have to say with dismay, Uruguay.

BUT, I advise caution here. Will the bond be an AG piece of toilet paper with fancy printing to fool the 'natives' as I'm sure TMBOA will be referring to Ghana.

OR will it be something worth having, such as a USD10M escrow account made in favour of Ghana to pass on to NML Capital Limited when the 'negotiation' by the AG spin-doctors goes tits up and they lose the case?

BRILLIANT, round 2 in progress, can't wait for round 3.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!