MercoPress. South Atlantic News Agency

Brazil limits Chinese state-controlled companies to joint bidding for largest offshore oil prospect

The Libra prospect is estimated to hold between 8 billion and 12 billion barrels of recoverable oil reserves

The Libra prospect is estimated to hold between 8 billion and 12 billion barrels of recoverable oil reserves Brazil is limiting Chinese state-controlled oil companies to joint bids to develop its largest offshore oil discovery, amid concerns the players could share data and reduce competition ahead of the 21 October auction, said Brazilian officials.

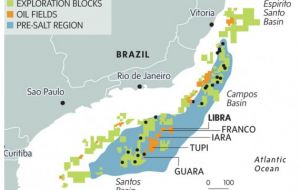

The auction will be the country’s first-ever under new production sharing agreements and includes the rights to develop the Libra prospect, a massive deep-water oil reserve located in a pre-salt area off the south-east coast of Brazil. The prospect is estimated to hold between 8 billion and 12 billion barrels of recoverable oil reserves, but could cost almost 200 billion dollars to develop over the 35-year life of the concession contract.

National oil companies, especially from Asia, dominated the list of 11 potential bidders released by Brazil’s National Petroleum Agency (ANP). However, this restriction on Chinese bids could further water down bidding after oil majors including ExxonMobil, BP and Chevron have already declined to participate, Reuters said.

China’s state-controlled CNPC and CNOOC will have to team up for a potential bid if both companies want to participate, ANP head of concession auctions, Claudia Rabello, was quoted.

“Companies that are part of the same group can't compete for the same block,” Rabello said, adding that the rule was not new and had been in place for previous concession auctions. The ANP is still considering whether to allow Chinese company Sinopec to bid on its own, ANP director Helder Queiroz told reporters.

Sinopec registered for the auction via its joint venture with Spain’s Repsol. It also holds a stake in the Brazilian unit of Portgual’s Galp Energia, which has registered for the auction.

Queiroz said there was a concern that companies in separate bidding groups had the same controlling shareholder – the Chinese government – and could potentially influence bidding because knowledge and strategies could be shared.

“What we want to ensure is that a condition of equality exists in the competition,” he said.

Petrobras CEO Maria das Gracas Foster and ANP director Magda Chambriard traveled to China to make presentations about the auction, and this new rule could end up undoing this promotional work.

“The Chinese detest concession auctions. They want to negotiate directly with the government,” said John Albuquerque Forman, a former ANP director who now runs a consulting business in Rio de Janeiro. He noted that Chinese oil companies have never participated in one of Brazil's concession auctions.

China's first entry into Brazil's oil industry came via several oil-for-financing deals in 2009 between Petrobras, CNPC and Sinopec. Sinochem later acquired a 40% stake in Statoil’s Peregrino field for about 3 billion dollars. That deal was followed by Sinopec's 7bn acquisition of a 40% stake in Repsol's Brazilian unit, forming the Repsol Sinopec joint venture, and a $5.2 billion purchase of a 30% stake in Petrogal.

According to Forman, Brazilian regulators could make an exception for Sinopec’s Brazilian stakes, despite the company being clearly controlled by the Chinese government.

“Given the circumstances, I expect the government to say that the joint venture is something different” and allow Repsol Sinopec and Petrogal, Galp's Brazilian unit, to submit separate bids from CNOOC and CNPC. In addition to CNOOC, CNPC and Petrobras, Japanese trading firm Mitsui & Co, India's ONGC Videsh, Malaysia's Petronas and Anglo-Dutch supermajor Shell also have qualified to participate.

Top Comments

Disclaimer & comment rules-

-

Read all commentsSomeone showing intelligence in the area at last!

Oct 08th, 2013 - 10:06 pm 0It was my understanding that ALL foreign companies had to undertake joint bidding with Petrobras.

Oct 09th, 2013 - 03:46 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!