MercoPress. South Atlantic News Agency

Tag: Sinopec Corp

-

Thursday, October 15th 2015 - 20:16 UTC

China to continue expanding its influence in the oil and gas sector

Since 2009, China has been taking a much more active role in its pursuit of international oil contracts. In 2009, for the first time, Saudi Arabia exported more of its oil to China than it did to the US. China also made large investments in Saudi Arabia's oil refining industry as well. But China's oil investments didn't stop there; they also pursued oil producing Canadian assets in 2011/12.

-

Tuesday, October 8th 2013 - 18:15 UTC

Brazil limits Chinese state-controlled companies to joint bidding for largest offshore oil prospect

Brazil is limiting Chinese state-controlled oil companies to joint bids to develop its largest offshore oil discovery, amid concerns the players could share data and reduce competition ahead of the 21 October auction, said Brazilian officials.

-

Monday, September 23rd 2013 - 16:41 UTC

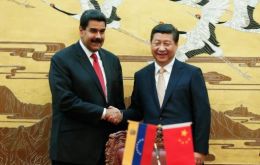

China/Venezuela cooperation agreements involving 20bn dollars including 5bn credit

Venezuelan President Nicolas Maduro and his Chinese counterpart, Xi Jinping, said they were committed to consolidating the strategic alliance between their two countries during a meeting in Beijing at which they signed a dozen cooperation and investment agreements worth 20 billion dollars.

-

Wednesday, September 18th 2013 - 06:43 UTC

China will help Venezuela develop a huge oil field investing 14bn dollars

China’s hydrocarbons company Sinopec and Venezuela’s PDVSA (Petroleos de Venezuela SA) agreed investments to develop the Junin 1 oil field in the Orinoco oil strip, which will demand 14 billion dollars for a daily extraction of 200.000 barrels, said PDVSA president Rafael Ramírez currently in Beijing.

-

Friday, August 30th 2013 - 00:34 UTC

China company takes 33% stake in US Apache Corp. oil and gas business in Egypt

China Petrochemical Corporation, Sinopec, has agreed to buy a 33% stake in the Egyptian oil and gas business of US firm Apache Corporation. Sinopec will pay Apache 3.1bn dollars in cash for the stake. The deal is the latest in a series of similar moves by Chinese oil firms as they look to secure energy supplies to meet growing domestic demand.

-

Monday, June 11th 2012 - 19:44 UTC

China cuts retail gasoline prices 5.5% to reflect cheaper oil and boost the economy

China, the world's second-biggest oil user, will reduce gasoline and diesel prices by the most since 2008 after global crude costs slumped. State-controlled retail gasoline prices will fall by 530 Yuan (83 dollars) a metric ton and diesel will be cut by 510 Yuan, the National Development and Reform Commission, NDRC, the nation's top economic planner, said on its website last week.

-

Friday, May 25th 2012 - 09:04 UTC

Repsol partner in a huge deposit off the Brazilian coast with 1.25bn barrels of oil

Spain’s Repsol, recovering from the recent seizure of YPF by the Argentine government, said an area off the coast of Brazil it is exploring with partner China Petroleum and Chemical Corp. contains the equivalent of at least 1.25 billion barrels of oil.

-

Thursday, April 19th 2012 - 05:08 UTC

YPF nationalization allegedly killed Repsol’s Chinese option to leave Argentina

China's state-owned Petrochemical Corp (Sinopec) spokesman Huang Wensheng came on stage to play down rumours indicating that Argentina's move to nationalize local oil company YPF, controlled by Spain's Repsol, has spoiled years of planning by Sinopec to buy the energy giant.

“We don't comment on market rumours,” Wensheng said. -

Wednesday, January 4th 2012 - 06:09 UTC

China’s Sinopec buys stake in five shale projects in the US

Devon Energy Corp announced Tuesday the sale to China’s Sinopec of a one-third stake in five shale projects in the United States. The terms of the deal call for China’s No. 2 oil company to pay 900 million dollars in cash to the US firm and contribute 1.6 billion toward the cost of drilling.

-

Friday, February 25th 2011 - 21:29 UTC

China Sinopec completes take over of US Occidental Petroleum assets in Argentina

China Petrochemical Group (Sinopec), China's largest oil refiner announced this week that U.S. Occidental Petroleum Corp. (NYSE:OXY) had completed handing over its Argentinean assets to it.