MercoPress. South Atlantic News Agency

Most Fed members agreed on December's stimulus reduction, indicate minutes

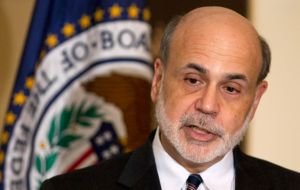

Bernanke is stepping down next February first

Bernanke is stepping down next February first Federal Reserve members mostly agreed about a reduction in the central bank's stimulus efforts in December, meeting minutes released Wednesday reveal. The central bank announced a $10bn a month reduction in its bond buying program at the end of its December meeting.

They decided to decrease stimulus efforts in “measured steps” to avoid surprising markets. Better than expected jobs growth was one reason cited for the pullback.

Some members, however, worried that financial market might misinterpret the move.

During the summer of 2013, comments made by outgoing chairman Ben Bernanke indicating a reduction in stimulus efforts caused market volatility and a steep increase in mortgage rates.

However, by the time an easing of the program, known as quantitative easing, was announced in December, investors were more relaxed about the move. All three US indexes posted gains of more than 25% in 2013.

In December, the Fed cut its purchases of mortgage bonds and US Treasury bonds from 85bn a month to 75bn a month in a move known as a “taper”. Most analysts expect that if US economic conditions continue to improve, the bank will continue to cut its purchases by 10bn after each policy meeting in 2014.

Fed members were eager to reassure markets that a reduction in bond buying did not indicate the bank was completely withdrawing its support of the US economy.

Some members pushed for a change in language that would show the central bank planned to keep short term interest rates low. As a result, in its December statement, the Fed said it would keep the short-term rate low “well past” the time the unemployment rate falls below 6.5%, as long as inflation remained in check.

Some members advocated changing the unemployment threshold to 6%, but that measure was overruled. The next US jobs report is scheduled to be released this Friday.

Members also discussed the long road ahead to re-normalize monetary policy.

As a result of its extraordinary stimulus efforts, the Fed has purchased over 4 trillion worth of bonds since the 2008-2009 financial collapse - a move that has worried many US politicians.

Incoming head Janet Yellen, who is scheduled to take over from Mr Bernanke on 1 February, has to decide how and when the bank will sell those bonds and return to its traditional task of raising and lowering the short term interest rate.

The central bank has engaged in bond buying because the rate, known as the federal funds rate, has been at zero since 2008. Markets were mixed on news of the minutes, with the Dow Jones and S&P 500 indexes trading lower while the tech-heavy Nasdaq rose

Top Comments

Disclaimer & comment rules-

Read all commentsOh dear, they are going to pull the rug from under “the economy”.

Jan 09th, 2014 - 03:26 pm 0Now we will see if Bernanke was correct OR will it all fallover like a deck of cards?

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!