MercoPress. South Atlantic News Agency

Argentina takes its differences with Judge Griesa to the US main journals

“Argentina wants to keep paying its debt, but they won't let it” reads the heading of the ads in the leading US journals

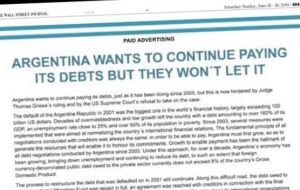

“Argentina wants to keep paying its debt, but they won't let it” reads the heading of the ads in the leading US journals Argentina on Sunday took its battle against paying hedge fund investors in its defaulted bonds to the US media, placing adverts in major newspapers demanding US courts help foster “fair and balanced” negotiations.

The full-page ad -- which appeared in The New York Times, The Washington Post and the weekend edition of The Wall Street Journal -- lashes out at the “voracity” of the so-called “vulture funds”.

“Paying the vulture funds is a path leading to default,” says the ad from the government of Argentine President Cristina Fernandez.

“The will of Argentina is clear: we expect a judicial decision that promotes fair and balanced negotiating conditions to resolve this protracted and difficult dispute.”

Last week, the US Supreme Court rejected Argentina's appeals against paying at least 1.3 billion to hedge fund investors who refused to take part in a restructuring deal for debt on which Buenos Aires defaulted in 2001.

By not taking the case, it let stand an August 2013 ruling from US appeals court judge Thomas Griesa -- one of the targets of Argentina's fury.

The Supreme Court thus opened the way for NML Capital and others to seek immediate payment on 100 percent of the face value of the bonds they hold, even though most of the country's creditors took a huge write-down of their bonds to help the government rebuild its finances.

“The vulture funds that secured a ruling in their favour are not original lenders to Argentina,” the ad says.

“They purchased bonds in default at obscenely low prices for the sole purpose of engaging in litigation against Argentina and making an enormous profit.”

Buenos Aires argues that it will in fact need to pay an estimated 15 billion “in the immediate future” -- or more than 50% of its foreign reserves.

“This ruling seeks to put Argentina in a delicate position, but also any country that may have to undertake a restructuring of its debts in the future,” the ad says.

On Friday, Griesa ordered Argentina to pay hedge fund bond holders in the United States, not Argentina -- effectively scuppering a government proposal for a debt exchange inside the country.

Buenos Aires has said it wants Griesa to set conditions for a negotiated settlement that would respect US and Argentine laws. But the judge has questioned Argentina's willingness to pay up.

In its Wall Street Journal ad, the government also ratifies its pro-negotiation stance, talks that President Cristina Fernández said must be guaranteed under “fair conditions.”

“The will of Argentina is clear: we expect a judicial decision that promotes fair and balanced negotiating conditions to resolve this protracted and difficult dispute that has affected, affects and will continue to affect the Argentine people due to the voraciousness of a minute group of speculators.”

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsComment removed by the editor.

Jun 23rd, 2014 - 04:45 am 0Meanwhile in Argentina....

Jun 23rd, 2014 - 05:04 am 0See above article!

Was the obscenely low rate the Vulture funds paid less than the obscenely low rate paid by Argyland to the other creditors?

Jun 23rd, 2014 - 05:26 am 0Don't know why Argyland just doesn't pay up, it's not that much dosh.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!