MercoPress. South Atlantic News Agency

Tag: debt-swap

-

Friday, August 22nd 2014 - 07:33 UTC

European holders of swapped Argentine bonds willing to accept removal of the RUFO clause

European investors holding 5.2 billion dollars of restructured Argentine bonds are negotiating the removal of the Rights Upon Future Options (RUFO) clause that Argentina claims prevents them from negotiating with holdout funds, it was reported in the Buenos Aires media.

-

Saturday, July 19th 2014 - 06:50 UTC

Italian chapter of holdouts tells Argentina it will continue to the last consequences

The Italian chapter of Task Force Argentina (TFA), an organization which represents bondholders that did not accept the 2005 and 2010 debt swaps, urged the government of President Cristina Fernandez to negotiate and warned it will keep on pursuing its interests until the last consequences.

-

Saturday, July 5th 2014 - 08:48 UTC

The Economist on Argentina: “The Luis Suarez of international finance”

In its latest edition The Economist writes about Argentina’s debt stand-off, and states this “reflects a teenage attitude that rules are there to be broken”.

-

Saturday, June 28th 2014 - 10:57 UTC

Argentina claims Judge Griesa “blocked the payment to bondholders”

Through an official press release published on Friday afternoon, the Argentine government stated US Federal Judge, Thomas Griesa, attempted to “block the payment for bondholders,” and committed an abuse of authority, after cancelling the deposit made on Thursday into a Bank of New York account.

-

Monday, June 23rd 2014 - 04:27 UTC

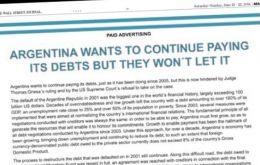

Argentina takes its differences with Judge Griesa to the US main journals

Argentina on Sunday took its battle against paying hedge fund investors in its defaulted bonds to the US media, placing adverts in major newspapers demanding US courts help foster “fair and balanced” negotiations.

-

Saturday, June 21st 2014 - 09:31 UTC

Cristina Fernandez calls for negotiations: “we want to pay 100% of creditors”

In a conciliatory speech compared to previous statements, President Cristina Fernandez said on Friday her government would negotiate with all of Argentina's creditors in a bid to avoid a new debt default that would further weaken the country's ailing economy.

-

Friday, June 20th 2014 - 07:21 UTC

After all: Argentina seems willing to start discussions with Griesa and hedge funds

After a day of fury and discussions with cabinet members, advisors and experts, Argentine president Cristina Fernandez will be sending a government delegation to New York to meet Judge Thomas Griesa and the hedge funds holdouts' solicitors and begin, hopefully, a round of negotiations to reach a settlement on the bonds litigation.

-

Wednesday, June 18th 2014 - 08:09 UTC

S&P and Argentina in six months: “default or distressed debt exchange”

Standard & Poor's cut its rating of Argentina's long-term foreign currency debt rating to CCC- from CCC+ with a “negative” outlook. A CCC rating is defined as “currently vulnerable and dependent on favorable business, financial and economic conditions to meet financial commitments,” according to S&P.

-

Wednesday, June 18th 2014 - 07:59 UTC

Argentine industrial and financial community call for 'dialogue' with holdouts

Argentina's industrial union and bank associations expressed their deep concern regarding Monday's US Supreme Court refusal to take the long standing case with the holdout hedge funds, and all called for a solution appealing to dialogue.

-

Wednesday, June 18th 2014 - 07:45 UTC

IMF concerned about 'wider systemic implications' of the US Supreme Court decision on Argentina

The International Monetary Fund is “concerned about wider systemic implications” the ruling by the US Supreme Court could prompt following its decision not to consider Argentina’s appeal aimed at staving off a default.