MercoPress. South Atlantic News Agency

Griesa rejects 'stay'; orders Argentina and holdouts to meet 'round the clock' to reach a deal

Griesa said an Argentine default would be “most unfortunate” because it would hurt 'real people' and urged Argentina to take “sensible steps”

Griesa said an Argentine default would be “most unfortunate” because it would hurt 'real people' and urged Argentina to take “sensible steps”  Argentina's lawyer Jonathan Blackman said the issues were too complex to resolve by the July 30 deadline

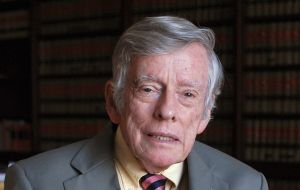

Argentina's lawyer Jonathan Blackman said the issues were too complex to resolve by the July 30 deadline US Judge Thomas Griesa rejected on Tuesday Argentina’s request for a suspension ('stay') on the ruling that ordered Buenos Aires to pay 1.3 billion dollars plus interests to holdout speculative funds and instructed Argentina and holdouts to meet on Wednesday morning for a first face-to-face meeting.

At the two and a half hour hearing called by Judge Griesa with legal representatives of Argentina and lawyers of holdout bondholders in New York, the District Court Judge rejected the Argentine government's request saying there is no need for a stay for negotiations to continue.

He ordered the parties to meet with Special Master Daniel Pollack and meet “continuously, round the clock, until a settlement is reached.” The first face-to-face meeting between Argentina and the holdouts was called for Wednesday at 11 a.m. (Argentine time).

A lead holdout creditor, Elliott Management's NML Capital Ltd, said in a statement it was prepared to meet with Pollack to resolve the dispute.

“We are confident this matter could be resolved quickly if Argentina would join us in settlement discussions,” NML said.

Argentina's lawyers in turn argued the country simply cannot pay holdouts by the July 30 deadline set by the Judge. Jonathan Blackman, a lawyer for Argentina, said the issues were too complex to resolve by the July 30 deadline and thus a settlement “can't be done by the end of the month.”

Blackman said one problem is that U.S. bondholders who are owed 1.5 billion after refusing to exchange their bonds for lower-valued bonds after the 2001 default are insisting they receive 100% of what they are owed.

“We want to negotiate a settlement with everyone, but to do that requires movement,” Blackman said.

He said that until the end of this year, the 92% of bondholders who exchanged their bonds are entitled to whatever improved treatment is given to bondholders who did not exchange for lower rates.

“In my view, the stay application is not something necessary to a negotiation or settlement,” Griesa said. He added “every single problem” described by Blackman can be dealt with in a settlement aimed at averting default.

“There are ways to somehow avoid a default,” the judge said.

Griesa said an Argentine default would be “most unfortunate” because it would harm 'real people' and urged the government to take “sensible steps” to avoid default. He bashed the government for its “incendiary rhetoric”.

“Judgments are judgments,” he underlined.

The meeting began at 11.30 a.m. with all eyes focused on the magistrate’s decision on Argentina’s request for a stay on the his ruling ordering Buenos Aires to pay 1.3 billion dollars plus interests to vulture funds that refused the country’s 2005 and 2010 debt swaps temporarily.

The hearing was originally requested by European bondholders that have not received payments from Argentina since June 30 due to Griesa’s ruling, along with the Euroclear and Clearstern financial services companies.

Other creditors with restructured bonds such as banks have also warned that the decision by the US judge to stop the payment in Europe goes against European jurisprudence, based on a similar case that Elliot Management, same holdout speculative fund now bringing a lawsuit against Argentina, brought against Nicaragua some years ago.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsIt's sad to see the country brought to its knees by incompetent leaders. CFK & team know no other way than to bluster. Such a crude & unskilled bunch.

Jul 23rd, 2014 - 01:45 am 0“”“We are confident this matter could be resolved quickly if Argentina would join us in settlement discussions,” NML said.“”

Jul 23rd, 2014 - 01:52 am 0a bit like the falklands then.... easily solved by sitting all the parties down, but despite giving argentina every chance, they keep dreaming up reasons not to - and then complaining the world is against them.

hilarious...

except for those poor saps still suffering from the non-poayment.. all of whoma re apaprently vultures, even the old pensioners who got shafted by yet another mad Argentine government.

If it wasnt for the idiocy and war mongering madness of Blair and his pals, i'd even be able to safely take the piss,, sadly our Gov, and the anti-anglo current Yank leader makes that impossible... all our leaders are as daft as the Argies.

At least the Aegies haven't declared war against a sovereign state recently..oh, but i guess they did invade their totally peaceful neighbour just to divert attention from their home-grown issues.

Thank god the Falklands dont have WMDs (except for those nuclear penguin attack squads) otherwise Blair might have invaded them too!

odd that, politicians, who needs em eh?

Argentina: just pay up already.... it was only yesterday Thinko-matic was saying how filthy rich you were in cash... then again, *yesterday” their money was a lot more valuable than it is today.

hohoho

It should be noted that US Attorney Blackman, representing Argentina, stated in a previous videotape that he would NOT honor the ruling of the US Court willingly, thus defying the US Court jurisdiction and authority.

Jul 23rd, 2014 - 02:40 am 0The Honourable US Judge Griesa is trying to actively move the Argentines off their backsides in order to settle after 12 years of stalling, before they default yet again.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!