MercoPress. South Atlantic News Agency

With Chinese New Year over, central bank reaffirms strong Yuan policy

Zhou's remarks come as Chinese markets reopen on Monday after a week-long New Year holiday. Efforts to defend the Yuan have eroded China's reserves.

Zhou's remarks come as Chinese markets reopen on Monday after a week-long New Year holiday. Efforts to defend the Yuan have eroded China's reserves.  At $3.23tn China still has the world's biggest reserve of foreign currency holdings. But that has declined by $420bn over six months, the lowest level since May 2012.

At $3.23tn China still has the world's biggest reserve of foreign currency holdings. But that has declined by $420bn over six months, the lowest level since May 2012.  In January alone, the reserves plunged by $99.5bn as the People's Bank of China sold dollars in an effort to shore up the value of the Yuan.

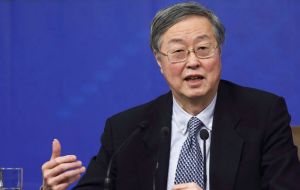

In January alone, the reserves plunged by $99.5bn as the People's Bank of China sold dollars in an effort to shore up the value of the Yuan. Chinese central bank governor Zhou Xiaochuan has accused “speculative forces” of targeting the country's currency, the Yuan, and argued there was no reason for the Yuan to keep depreciating in value and that China would not let international speculators dominate market sentiment.

Zhou's remarks come as Chinese markets prepare to reopen on Monday after a week-long New Year holiday. Efforts to defend the Yuan have eroded China's foreign currency reserves.

At $3.23tn China still has the world's biggest reserve of foreign currency holdings. But that has declined by $420bn over six months and stands at the lowest level since May 2012.

In January alone, the reserves plunged by $99.5bn as the People's Bank of China sold dollars in an effort to shore up the value of the Yuan.

Zhou's comments came in an interview published in the Caixin financial magazine.

“International speculative forces have recently focused on shorting China”, the People's Bank of China governor told the magazine, without giving further details.

He dismissed fears that China's currency reserves were declining too fast, saying: “It is normal for foreign reserves to rise and fall as long as the fundamentals face no problems.”

The Chinese economy posted growth of 6.9% in 2015, its slowest rate since 1990. Fears of an economic slowdown have caused some investors to move their money out of China in search of better returns elsewhere.

However, Mr Zhou said China would not tighten its capital controls as a result. “Capital outflow and capital flight are two different concepts,” he added.

Chinese authorities fear a rapid devaluation of their currency, as it could destabilize the economy. Many Chinese businesses hold debt in dollars and managing those debts with a severely weakened Yuan could cause problems and some companies to fail.

So China has been trying to engineer an ordered devaluation of the Yuan, but that is proving hard to deliver. Investors have been trying to pull funds out of investments priced in Yuan and speculators have been betting on further falls in the currency.

To stabilize the situation, China has been selling dollars and buying Yuan. And it has been using other tactics, including curbing currency speculation and ordering offshore banks to retain their reserves of Yuan.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsThe equity market should be taxed when entering in the BRICS countries.

Feb 15th, 2016 - 10:37 am 0Besides the tax should only be accepted himself yuan as free movement of currency among the BRICS.

I do not see any rationale to continue operating these economic fundamentals in dollars. The dollar should only be accepted in trade with the United States. Only!

With the rest of the world should be used as the Yuan currency basis. This would avoid speculation.

@ 1 Stupid bugger.

Feb 15th, 2016 - 11:03 am 0To the rational people who read these comments:

The mouth piece for the Chin gang of crooks needs to be very careful when he reads these comments designed to strengthen the Yuan.

Allowing it to 'free fall until it hits the bottom' is a bit of a worry. Expecting it to bounce is a bit silly unless it's of the 'dead cat' variety.

Still, it's only the Yuan shit! Who GAF?

@ Mr. Crybaby,

Feb 15th, 2016 - 11:08 am 0The garbage that you write is typical of decadent cultures. Many bad words and no argument.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!