MercoPress. South Atlantic News Agency

China's growth cools to its weakest since the global financial crisis

The economy grew 6.5% in the 3Q from a year earlier, below an expected 6.6% rate, and slower than 6.7% in the 2Q, the National Bureau of Statistics

The economy grew 6.5% in the 3Q from a year earlier, below an expected 6.6% rate, and slower than 6.7% in the 2Q, the National Bureau of Statistics  China’s Vice Premier Liu He, who oversees the economy and financial sector, also chimed in to bolster sentiment.

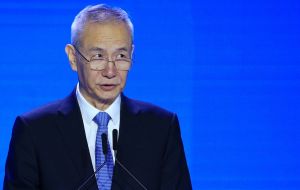

China’s Vice Premier Liu He, who oversees the economy and financial sector, also chimed in to bolster sentiment. China's economic growth cooled to its weakest quarterly pace since the global financial crisis, with regulators moving quickly to calm nervous investors as a years-long campaign to tackle debt risks and the trade war with the United States began to bite.

Chinese authorities are trying to navigate through numerous challenges, as the trade war fears have sparked a blistering selloff in domestic stock markets and a steep decline in the value of the Yuan versus the dollar, heightening worries about the growth outlook.

The economy grew 6.5% in the third quarter from a year earlier, below an expected 6.6% rate, and slower than 6.7% in the second quarter, the National Bureau of Statistics said on Friday. It marked the weakest year-on-year quarterly gross domestic product growth since the first quarter of 2009 at the height of the global financial crisis.

“The trend of slowdown is strengthening despite Chinese authorities’ pledge to encourage domestic investment to support the economy. Domestic demand turned out weaker than unexpectedly solid exports,” said Kota Hirayama, senior emerging markets economist at SMBC Nikko Securities in Tokyo.

After another big decline in Chinese stocks on Thursday, policymakers launched a coordinated attempt to soothe markets, with central bank governor Yi Gang saying equity valuations are not in line with economic fundamentals.

Yi and senior regulators pledged targeted measures to help ease firms’ financing problems and encourage commercial banks to boost lending to private firms. China’s Vice Premier Liu He, who oversees the economy and financial sector, also chimed in to bolster sentiment.

The Shanghai Composite index, which slumped more than one per cent in early Friday deals, rallied strongly in afternoon trading to finish up 2.6%. Third quarter growth was hurt by the weakest factory output since February 2016 in September as automobile makers cut production by over 10% amid a sales slowdown.

On a quarterly basis, growth cooled to 1.6% from a revised 1.7% in the second quarter, meeting expectations. Importantly, second-quarter sequential growth was revised down from the previously reported 1.8%, suggesting the economy carried over less momentum into the second half than many analysts had expected.

China’s once high-flying automakers are now feeling the brunt of weaker consumer spending. Car sales fell the most in nearly seven years in September, data showed last week, with GM and Volkswagen reporting double-digit declines.

Top Comments

Disclaimer & comment rules-

Read all commentsPapa Maga spank your rotten bottoms? Huh?

Oct 20th, 2018 - 11:50 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!