MercoPress. South Atlantic News Agency

China's industrial growth output fell to a 17-year low in Jan/Feb

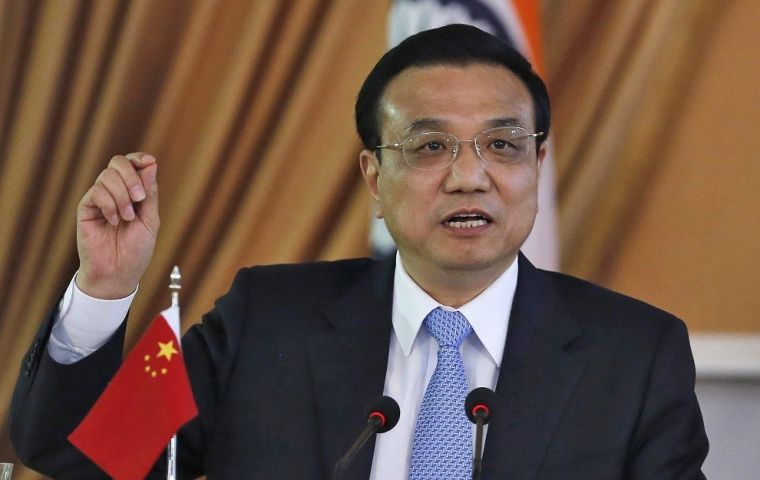

Premier Li Keqiang last week announced hundreds of billions of dollars in additional tax cuts and infrastructure spending

Premier Li Keqiang last week announced hundreds of billions of dollars in additional tax cuts and infrastructure spending Growth in China’s industrial output fell to a 17-year low in the first two months of the year, pointing to further weakness in the world’s second-biggest economy that is likely to trigger more support measures from Beijing.

But a mixed bag of major data on Thursday also showed property investment is picking up, while overall retail sales were sluggish but steady, suggesting the economy is not in the midst of a sharper slowdown at present.

China is ramping up assistance for the economy as 2019 growth looks set to plumb 29-year lows, but support measures are taking time to kick in. Most analysts believe activity may not convincingly stabilize until the middle of the year.

Premier Li Keqiang last week announced hundreds of billions of dollars in additional tax cuts and infrastructure spending, even as officials vowed they would not resort to massive stimulus like in the past, which produced swift recoveries in China and strong reflationary pulses worldwide.

“The latest data should partially ease concerns about a sharp slowdown at the start of the year. But the near-term outlook still looks downbeat,” Capital Economics said in a note.

In particular, Capital Economics and others noted that infrastructure investment has not improved as much as hoped after the government began fast-tracking road and rail projects last year, raising the risk of a milder-than-expected bounce in construction when work resumes in warmer weather.

Industrial output rose 5.3% in January-February, less than expected and the slowest pace since early 2002. Growth had been expected to slow to 5.5% from December’s 5.7%..

China combines January and February activity data in an attempt to smooth distortions created by the long Lunar New Year holidays early each year, but some analysts say a clearer picture of the economy’s health may not emerge until first-quarter data is released in April.

If the seasonal distortion was removed, output rose 6.1% in the two months, the National Bureau of Statistics said.

China’s own official factory survey, which is seasonally adjusted, showed manufacturing output contracted in February for the first time since January 2009. China’s manufacturers are facing weaker sales at home and abroad, with exports hit by U.S. tariffs on Chinese goods and cooling global demand.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!