MercoPress. South Atlantic News Agency

April inflation in Argentina eases but reaches 3.4% and an annualized 55.8%

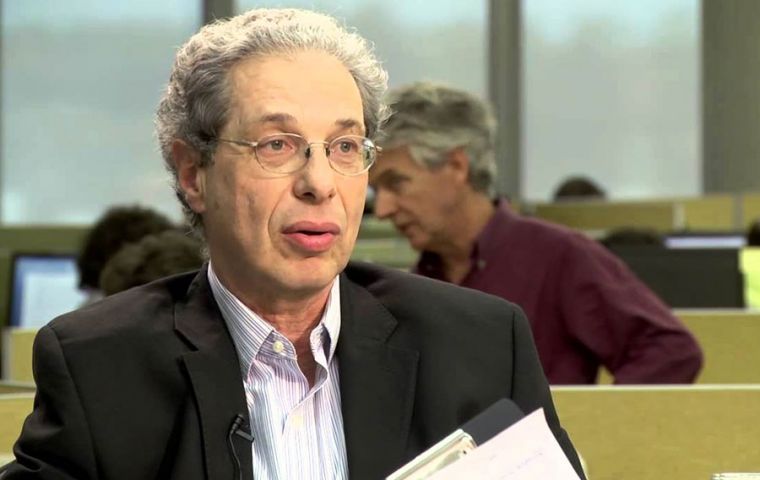

“The great battle is inflation, and then also the recession,” Daniel Marx, Argentina's former finance secretary, said in an interview

“The great battle is inflation, and then also the recession,” Daniel Marx, Argentina's former finance secretary, said in an interview Argentina released April inflation numbers on Wednesday, with the monthly price rise easing to 3.4% - high by international standards, but below market expectations and reversing an acceleration trend that began in January.

That will provide some mild relief for President Mauricio Macri, whose popularity in opinion polls has been hammered by accelerating inflation since the start of the year.

Signs of a cooling-off in price rises over the next few months would calm anxious investors and voters, and bolster Macri as he tries to revive growth in the recession-hit country and runs for a second term in office in October.

“The great battle is inflation, and then also the recession,” Daniel Marx, Argentina's former finance secretary, said in an interview on Wednesday. “I think on the inflation front some things causing concern today may be diminishing, but we need to watch how the exchange rate evolves and then its effect on prices.”

April had been touted by analysts and officials as a potential turning point. Nonetheless, 12-month inflation is still running at 55.8% while prices are up 15.6% so far this year.

Macri's administration has rolled out measures to rein in prices and protect the embattled peso, which is down over 16% against the U.S. dollar this year, making it one of the world's worst-performing currencies. It lost half its value last year.

Argentina is also stuck in recession with sky-high interest rates sapping growth and hitting jobs. Poverty rates are rising, bolstering political rivals, including populist ex-President Cristina Fernandez de Kirchner.

The economic woes - and political uncertainty - have spooked financial markets, with bond yields spiking as investors price in a higher chance of restructuring or default under a new leadership.

“From an electoral standpoint, it's hard to underestimate the importance of inflation in Argentina. It's the defining factor in how much people can buy and what their salary is worth,” said Thomaz Favaro, a regional director for consultancy Control Risks.

Favaro said the government would likely play up the slower monthly inflation as a victory, but that with 12-month inflation still so high, the battle to tame it ahead of the elections was “already lost.”

Ilya Gofshteyn, New York-based senior emerging markets strategist at Standard Chartered Bank, said a slower rise would enable Macri to say things were moving in the right direction, even if the economy remained fragile.

“I think at the end of the day there are also just forces outside of Macri's control,” he said.

Most analysts agree the outcome of the presidential election in October will depend on whether or not Macri can revive the economy, including reining in inflation and protecting the peso.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!