MercoPress. South Atlantic News Agency

United States need an independent Federal Reserve

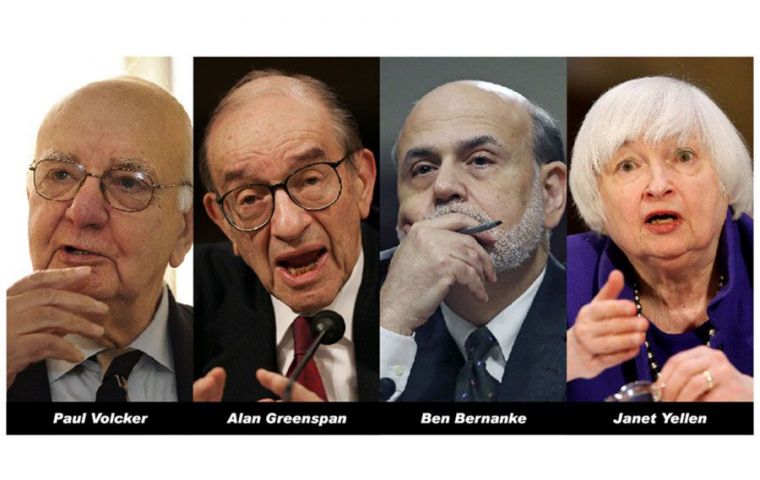

The following article was published 6 August, in the Wall Street Journal, signed by ex-Fed chiefs Paul Volcker, Alan Greenspan, Ben Bernanke and Janet Yellen. Basically, it states that the US economy functions best when the central bank is free of short-term political pressures.

As former chairs of the board of governors of the Federal Reserve System, we are united in the conviction that the Fed and its chair must be permitted to act independently and in the best interests of the economy, free of short-term political pressures and, in particular, without the threat of removal or demotion of Fed leaders for political reasons.

Collectively, we served our nation across nearly 40 years and were appointed and reappointed by six presidents, both Republican and Democratic. Each of us had to make difficult decisions to help guide the economy toward the Fed’s legislated goals of maximum employment and stable prices. In retrospect, not all our choices were perfect. But we believe those decisions were better for being the product of nonpartisan, nonpolitical assessments based on analysis of the longer-run economic interests of U.S. citizens rather than being motivated by short-term political advantage.

The Fed’s nonpartisan status doesn’t mean it is unaccountable. Congress sets the Fed’s powers and charges it with maximizing employment and promoting stable prices. The chair and other Fed leaders testify before Congress and speak regularly in public, explaining their views of the economy and how they plan to meet their mandates. Presidents, members of Congress, financial-market participants, pundits and many private citizens advocate that the Federal Reserve make particular monetary policy decisions. In our system of government, that is the right and privilege of every person, one we don’t question. The Fed welcomes open dialogue, as evinced by the “Fed Listens” program, in which Fed leaders have engaged with the public about possible changes to the Fed’s policy framework. A robust public debate helps make monetary policy better.

History, both here and abroad, has shown repeatedly, however, that an economy is strongest and functions best when the central bank acts independently of short-term political pressures and relies solely on sound economic principles and data. Examples abound of political leaders calling for the central bank to implement a monetary policy that provides a short-term boost to the economy around election time. But research has shown that monetary policy based on the political (rather than economic) needs of the moment leads to worse economic performance in the long run, including higher inflation and slower growth. Even the perception that monetary-policy decisions are politically motivated, or influenced by threats that policy makers won’t be able to serve out their terms of office, can undermine public confidence that the central bank is acting in the best interest of the economy. That can lead to unstable financial markets and worse economic outcomes.

Because nonpartisan, independent monetary policy is so important, Congress wisely established the Federal Reserve as an independent agency with regional participation and safeguards against political manipulation. Among these safeguards are 14-year terms for Federal Reserve Board members (four years for the chair and vice chairs) and the provision that Fed governors, including the chair and vice chairs, may be removed only for a cause related to violations of law or similar misbehavior, and not for policy differences with political leaders. This system of fixed terms is designed to ensure that the Fed makes decisions that best serve the economy—and all of us—regardless of short-term political considerations.

Elections have consequences. That certainly applies to the Federal Reserve as well as to other government agencies. When the current chair’s four-year term ends, the president will have the opportunity to reappoint him or choose someone new. That nomination will have to be ratified by the Senate. We hope that when that decision is made, the choice will be based on the prospective nominee’s competence and integrity, not on political allegiance or activism. It is critical to preserve the Federal Reserve’s ability to make decisions based on the best interests of the nation, not the interests of a small group of politicians.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!