MercoPress. South Atlantic News Agency

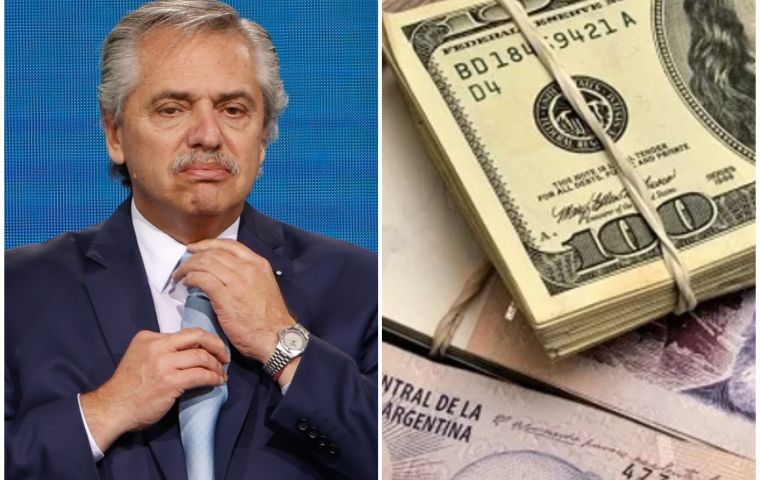

Argentina: How did the President's announcement hit the foreign exchange market?

It was the second consecutive day of acquiring dollars for the BCRA.

It was the second consecutive day of acquiring dollars for the BCRA. President Alberto Fernández's announcement Friday that he would not seek reelection this year triggered the US dollar further up against the Argentine peso, reaching AR$437 / AR$442 (buy/sale) at the “blue” (a euphemism for “black market”) exchange rate. Meanwhile, the official rate stood at AR$217/AR$225 (buy/sale), for a gap of 102.26% between the two quotations.

The Central Bank (BCRA) bought US$289 million Friday, for a positive balance of US$ 81 million so far this month. As a result of agricultural dollar transactions, an income of US$ 185 million was recorded, so that the accumulated result in this third stage reached US$ 1.285 billion.

Read also: Argentine President Fernández won't seek another term: “We did not achieve everything”

It was the second consecutive day of purchasing. On Thursday, it had acquired US$ 44 million, when the agrodollar contributed US$ 72.288 billion. On Wednesday there was no income from the agricultural dollar.

The BCRA Bank lost nearly US$ 3.25 billion in reserves so far this year due to sales in the foreign exchange market.

Also on Thursday, the monetary authority decided to raise from 78% to 81% the rates that fixed term deposits and other financial market references yield, amid the exchange tension and high inflation.

Agriculture Secretary Juan José Bahillo projected that “regional economies can double their exports up to US$ 20 billion by 2033”, and assured that there is “political will” to do so.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!