MercoPress. South Atlantic News Agency

Economy

-

Monday, September 17th 2007 - 21:00 UTC

Greenspan in housing market warning

World-renowned economist Alan Greenspan has warned that Britain's housing market is set to turn and predicted a difficult time ahead for homeowners

-

Monday, September 17th 2007 - 21:00 UTC

UK: Farmers' auction off due to ban

Britain's biggest sale of breeding lambs has been cancelled because of restrictions on animal movements.

-

Monday, September 17th 2007 - 21:00 UTC

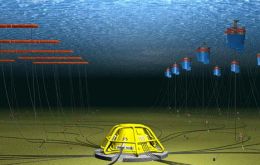

UK: Pioneering wave farm approved

The Government will give planning approval for the world's first large scale wave farm off the UK coast.

-

Monday, September 17th 2007 - 21:00 UTC

EU immigrant 'blue card' to attract skilled workers

The European Union's top justice official is advocating for the bloc to open it's doors to 20 million more immigrant workers over the course of the next two decades.

-

Monday, September 17th 2007 - 21:00 UTC

UK Government guarantees bank deposits

Ministers took dramatic action in an attempt to end the crisis at Northern Rock as Chancellor Alistair Darling announced the Government would guarantee all deposits with the bank.

-

Sunday, September 16th 2007 - 21:00 UTC

China tries to cope with inflation, liquidity and bubbles

China raised interest rates on Friday for the fifth time this year, in the latest of a series of tightening steps to cap inflation and prevent the world's fastest growing economy from overheating.

-

Sunday, September 16th 2007 - 21:00 UTC

“The Great Uruguayan Tannat Tasting, New York”

“Uruguay's wine industry, particularly Tannat, received ample praise from New York City's gourmets and media during the recent Fourth Annual Great Tannat Tasting.”

-

Sunday, September 16th 2007 - 21:00 UTC

Fire in Paraguay is well beyond human control

Wind-blown fires scorching the parched Paraguayan countryside have scarred almost 3 million acres of forest, brush, pasture and farmland, officials said Friday, forcing the evacuation of 15,000 people and threatening nature reserves.

-

Friday, September 14th 2007 - 21:00 UTC

Kirchner top official admits Argentine double digit inflation

Argentine Central Bank President Martin Redrado said the bank is “deeply concerned” about the country's inflation rate, the strongest statement so far from a member of the President Kirchner administration.

-

Friday, September 14th 2007 - 21:00 UTC

Uruguay tries more orthodox economics to tame inflation

Uruguay's government launched this week a package of seven price-cutting measures on goods and services aimed at containing, which rose to 8.2% in the first eight months of the year far above the annual target of 6.5%.