MercoPress. South Atlantic News Agency

Economy

-

Wednesday, September 5th 2007 - 21:00 UTC

Beige Book shows Fed in no rush to cut interest rates

The United States economy is feeling a “limited” impact from the credit re-pricing and weak housing industry, the Federal Reserve said in its Beige Book report Wednesday. The report suggested the Fed may not be in a rush to aggressively cut interest rates despite skittish financial markets.

-

Tuesday, September 4th 2007 - 21:00 UTC

Controversy over how fast China is really growing

While many people believe China will effectively quite soon become the world's second economy and catch up with United States sometime this century, MIT Professor Lester Thurow for a range of reasons argues that China's century will not be this one, but the next.

-

Tuesday, September 4th 2007 - 21:00 UTC

US leads the world in labour productivity says ILO

While productivity levels have increased worldwide over the past decade, gaps remain wide between the industrialized region and most others, although South Asia, East Asia, and Central & South-Eastern Europe (non-European Union) & CIS have begun to catch up the International Labor Office (ILO) said in a new report published Monday.

-

Tuesday, September 4th 2007 - 21:00 UTC

Record wheat prices on possible Russian shipments curb

Wheat rose to a record in Paris on Monday as traders speculated that Russia could curb shipments to restrain domestic food prices. Moscow has formed a working group that will consider measures to curb grain prices, which may include sales from state inventories as well as export duties and quotas.

-

Tuesday, September 4th 2007 - 21:00 UTC

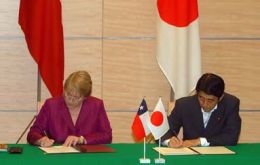

Bachelet signs free trade pact with Japan in Tokyo

On the first day of Chilean President Michelle Bachelet's trip to Japan, she and Japanese Prime Minister Shinzo Abe signed a Free Trade Agreement (FTA), which came into effect immediately. That accord is expected to create 50,000 new jobs and significantly increase Chile's exports to Japan.

-

Tuesday, September 4th 2007 - 21:00 UTC

Unemployment and informality threaten young Latinamericans

Unemployment, informality and inactivity endanger prospects of some 106 million young people in Latin America and the Caribbean in the labour market, and hinder potential economic growth and the fight against poverty in the region according to a new report of the International Labour Office (ILO) issued in Santiago de Chile on Tuesday.

-

Monday, September 3rd 2007 - 21:00 UTC

Southern Chile has highest average food prices

According to a study conducted by the Chilean daily La Tercera, Coyhaique and Puerto Montt are the Chilean cities with the highest average food prices.

-

Saturday, September 1st 2007 - 21:00 UTC

July inflation in US and Euro Zone remained stable

The United States Federal Reserve's preferred inflation guide grew less than expected in July, increasing the possibility of a cut in US interest rates next month.

-

Saturday, September 1st 2007 - 21:00 UTC

Latinamerican markets react positively to Bernanke's comments

Latinamerican markets reacted positively on Friday to comments from Federal Reserve Chairman Ben Bernanke. In Brazil, the benchmark Bovespa stocks index rose 3.41% in intraday trading, tracking strong gains on Wall Street.

-

Friday, August 31st 2007 - 21:00 UTC

WTO to investigate alleged Chinese industrial subsidies

The World Trade Organisation announced Friday it will investigate whether Chinese industrial subsidies breach international trade rules following a complaint by the United States and Mexico.