MercoPress. South Atlantic News Agency

Economy

-

Thursday, May 19th 2022 - 09:35 UTC

China building a new port and industrial hub in Peru, US$ 3bn investment, 55kms north of Lima

Global chain transport challenges, the war in Ukraine, and following two years of lockouts caused by the Covid 19 pandemic have caused many disruptions to normal trade and China has thus embarked in a major project building a new port along the Peruvian coast to help boost trade along the Pacific rim.

-

Thursday, May 19th 2022 - 09:15 UTC

Brazilian government lowers tariffs on eleven products to help with inflation

The Brazilian government facing the inflationary challenge, as in most of the rest of the world, and particularly when it comes to food prices and the millions of Brazilians who survive on a daily ration, has decided to temporarily reduce tariffs on eleven products. The decree came into effect on May 12 and will continue until the end of the year.

-

Thursday, May 19th 2022 - 08:58 UTC

April inflation in UK, highest in 40 years with worsening prospects before it moderates

The United Kingdom's cost of living worsening situation was confirmed by April's inflation rate which soared to a 40-year high of 9% boosted by food and energy prices.

-

Wednesday, May 18th 2022 - 09:58 UTC

Uruguay central bank increases rate, anticipates a 'contractive monetary policy' to combat inflation

Uruguay's central bank on Tuesday announced an increase of 75 basis points to 9,25%, in its monetary policy reference rate, meaning also the bank has entered the contractive phase, as so many other Latin American central banks, in an effort to rein in inflation.

-

Tuesday, May 17th 2022 - 09:40 UTC

Stockholm will try to lift Turkey's objection to Sweden's NATO membership

NATO secretary-general Jens Stoltenberg has said that Sweden and Finland's applications to join the alliance will be fast-tracked. Explaining the decision behind her country's intention to become a member, Swedish Prime Minister Magdalena Andersson said abandoning decades of political neutrality was a direct result of the Russian invasion of Ukraine.

-

Monday, May 16th 2022 - 09:55 UTC

Uruguay is Paraguay's gateway to the world, both Presidents agree

Paraguayan President Mario Abdo Benítez Sunday stressed his country needed Uruguay's help to secure a sovereign presence to have a way out to the sea so that its exports can reach the world and that Montevideo “has always been a port of exit.”

-

Monday, May 16th 2022 - 09:50 UTC

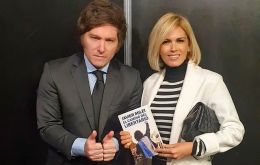

Milei: “I will not apologize for having a penis”

Argentine Congressman Javier Milei Saturday announced that if he is elected President next year one of his first measures would be to suppress the Ministry of Women (officially known as “Ministry of Women, Gender, and Diversity”).

-

Monday, May 16th 2022 - 09:29 UTC

Argentina preparing to become a BRICS member with support from China and Brazil

Argentina has been invited by Chinese president Xi Jinping to participate in three BRICS events taking place in the coming four weeks. The first will be a get-together of political parties, social organizations and think tanks, a second on May 20th, is a summit of foreign ministers from Brazil, Russia, India, China, and South Africa, BRICS full members, and the Argentine minister guest. Finally, on June24 a summit of the five-plus one leaders is scheduled.

-

Monday, May 16th 2022 - 09:26 UTC

Weighting SDR's currency basket, Dollar and Yuan up; Euro, Yen and Pound down

IMF increased the Chinese Yuan's weighting in the Special Drawing Rights (SDR) currency basket to 12.28% from 10.92% in its first regular review of the SDR valuation since the Chinese currency was first included in the basket in 2016, the Chinese central bank, PCB, reported on Sunday.

-

Saturday, May 14th 2022 - 08:33 UTC

Brazil invited to abide by OECD codes of good practices

Brazilian economic authorities Friday announced they had received an invitation from the Organization for Economic Cooperation and Development (OECD) Council to abide by both the Capital Movements Liberalization Code and the Intangible Current Operations Liberalization Code.