MercoPress. South Atlantic News Agency

Economy

-

Monday, February 2nd 2026 - 17:43 UTC

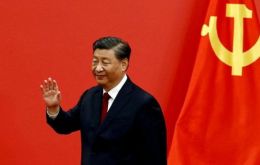

China’s Xi calls to make Renminbi “a powerful currency,” as Trump is ready to change Fed’s chair

China’s President Xi Jinping has called for the renminbi to achieve global reserve currency status, “a powerful currency” according to remarks published on Saturday in Qiushi, the Chinese Communist Party’s flagship ideology journal.

-

Friday, January 30th 2026 - 18:50 UTC

Trump taps Kevin Warsh to lead the Federal Reserve, setting up a high-stakes confirmation fight

Donald Trump said on Friday he will nominate Kevin Warsh, a former Federal Reserve governor, to become the next chair of the U.S. central bank, replacing Jerome Powell when Powell’s term as chair expires in May. The announcement, delivered via Truth Social, follows months of speculation over who would inherit the world’s most consequential monetary-policy job.

-

Friday, January 30th 2026 - 09:30 UTC

Argentina’s central bank extends dollar-buying streak, pushing reserves to a Milei-era high

Argentina’s central bank (BCRA) posted another net purchase in the foreign-exchange market on Thursday, buying US$52 million and logging a 19-session streak of net buying, according to figures reported by local media. Over that run, the bank accumulated US$1.134 billion, while gross reserves rose to US$46.24 billion, the highest level since 2021 and the strongest reading since President Javier Milei took office.

-

Friday, January 30th 2026 - 05:35 UTC

Uruguay’s Orsi heads to China with large delegation to deepen trade and strategic ties

Uruguayan President Yamandú Orsi has departed for China at the head of a roughly 150-strong delegation, framing the trip as a bid to “increase commercial and economic development” with Uruguay’s top trading partner. Before leaving, Orsi formally handed executive authority to Vice President Carolina Cosse, while the mission’s schedule in Beijing and Shanghai blends top-level political meetings with trade promotion and academic cooperation.

-

Friday, January 30th 2026 - 05:16 UTC

Trump threatens tariffs on countries supplying oil to Cuba, tightening pressure on Mexico

U.S. President Donald Trump signed an executive order that opens the door to imposing tariffs on imports from countries deemed to be supplying crude oil to Cuba, a move designed to raise the external cost of keeping Havana’s energy lifeline open and further constrain fuel flows to the island.

-

Thursday, January 29th 2026 - 05:29 UTC

Latin American presidents seek common ground as regional blocs weaken

Seven sitting heads of government and one president-elect from Latin America and the Caribbean shared the stage in Panama on Wednesday to call for deeper regional integration, an increasingly rare show of cross-ideological alignment in a polarized region. The message was delivered at the International Economic Forum Latin America and the Caribbean, backed by CAF and designed as a high-level convening point for governments, business leaders and multilaterals.

-

Thursday, January 29th 2026 - 00:01 UTC

Uruguay’s farm sector warns low dollar threatens jobs as peso strength squeezes exports

Uruguay’s Rural Association (ARU) is warning that the slide in the U.S. dollar is pushing the farm sector into a “critical situation,” arguing that while a stronger peso may feel beneficial for people paid in local currency, the broader impact can be job losses in export-oriented activities.

-

Wednesday, January 28th 2026 - 09:49 UTC

Lula and Chile’s president-elect Kast meet for the first time in Panama ahead of ‘Latin Davos’ forum

Brazil’s President Luiz Inácio Lula da Silva and Chile’s president-elect José Antonio Kast held their first bilateral meeting in Panama on Tuesday, shortly after arriving for the International Economic Forum for Latin America and the Caribbean — an event promoted by organizers and regional media as a “Latin Davos.”

-

Tuesday, January 27th 2026 - 15:33 UTC

EU and India seal historic trade deal after 18 years of talks

New Delhi and Brussels announced on Tuesday that they had concluded the largest bilateral trade deal in their histories after almost two decades of negotiations. The pact links India’s 1.4 billion-person economy with the 27-nation European Union and, according to both sides, will create a free-trade zone for around 2 billion consumers and sharply lower tariffs and other barriers that have long hindered commerce between the two regions.

-

Tuesday, January 27th 2026 - 10:18 UTC

Uruguay Central Bank accelerates easing, cuts key rate to 6.5% as dollar hits lows

Uruguay’s Central Bank (BCU) cut its benchmark policy rate by 100 basis points to 6.5% and said monetary policy “enters an expansionary phase,” framing the move as a way to prevent inflation from drifting away from its 4.5% target and to respond to recent strains in the foreign-exchange market.