MercoPress. South Atlantic News Agency

Tag: Ana Botin

-

Thursday, June 8th 2017 - 07:02 UTC

Santander rescues Banco Popular, which was “failing or likely to fail”

Spanish Banco Popular has been rescued from the brink of collapse by larger rival Santander for one Euro. Buying Banco Popular will cost Santander 7bn euros, around 2bn euros more than analysts had expected. Banco Popular was described by the European Central Bank as “failing or likely to fail” due to its dwindling cash reserves.The bank has struggled after billions in property investments turned sour.

-

Tuesday, November 22nd 2016 - 09:00 UTC

Santander bank confident of Brazil's “rapid recovery”

President Michel Temer met on Monday with Banco Santander chairman Ana Botin, who expressed the Spanish banking giant's confidence in Brazil's economic future despite the current downturn being experienced by Latin America's largest economy.

-

Friday, July 31st 2015 - 06:08 UTC

UK overtakes Brazil as Santander's most profitable market

The UK has become Santander's most profitable market, generating just over a fifth of the bank's profits in the first half of 2015. Pre-tax profits in the UK rose £74m to £928m, while revenues were up 5%. The results eclipsed the €1bn (£700m) posted by the Spanish bank's Brazilian operation, which saw its revenues jump by 9%.

-

Wednesday, November 26th 2014 - 06:56 UTC

Ana Botin reshuffles Santander, names new CEO and promotes other managers

Spain's Santander, the biggest bank in Europe by market value, reshuffled its command naming Jose Antonio Alvarez as its new chief executive replacing Javier Marin after his two years in the job, the bank said in a statement.

-

Tuesday, September 16th 2014 - 05:20 UTC

Santander new chairwoman confirms full control of the Brazil branch

Spanish banking giant Santander under its new executive chairperson Ana Botin announced on Monday the purchase of the remaining 25% of Banco Santander Brasil which it did not already own.

-

Friday, September 12th 2014 - 03:37 UTC

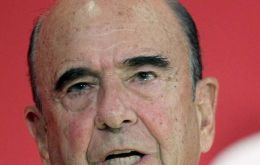

Emilio Botin, “El presidente” and the 'unofficial king of Spain'

Emilio Botin, “El Presidente” to co-workers and the third generation of Botins to run Santander, was at the forefront of a drive to create global banks, offering a one-stop shop to multinational companies and a range of services to consumers.

-

Thursday, September 11th 2014 - 15:46 UTC

Ana Botin appointed new chairwoman of Spanish banking giant Santander

Ana Botin has been appointed the new chairwoman of the Spanish banking giant Santander, following the death of her father, Emilio Botin, who died of a heart attack on Tuesday night.

-

Wednesday, October 17th 2012 - 04:43 UTC

Santander desists from purchase of 316 branches from Royal Bank of Scotland

Royal Bank of Scotland's proposed sale of 316 branches and other interests to Santander has collapsed. The Spanish bank pulled the plug on the sale, saying that the already-delayed deal could not be completed by the revised deadline.