MercoPress. South Atlantic News Agency

Tag: copper

-

Thursday, November 5th 2020 - 09:32 UTC

Chilean mining industry lobby cautions about the rewriting of the new constitution

Chile’s world-leading copper industry will see investment lag for at least two years as the country rewrites a constitution that underpinned nearly three decades of mining growth in the South American nation.

-

Saturday, October 31st 2020 - 08:14 UTC

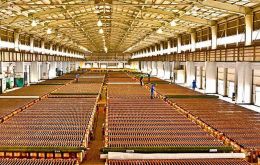

Chile's Codelco, world's largest copper producer reports profits are back

Chile's State-owned miner Codelco, the world's largest copper producer, on Friday reported a 86% increase in its profit for the first nine months of the year on Friday, to US$1,124 billion, amid an increase in production.

-

Monday, July 13th 2020 - 08:39 UTC

Copper prices hit their highest in two years, over a Chilean miners' strike

Shanghai copper hit its highest in nearly 25 months on Monday, while London copper scaled a 24-month high, on supply worries from top producer Chile due to a potential strike at a mine.

-

Friday, July 10th 2020 - 07:56 UTC

Copper recovering strongly, and at its highest levels since January

Copper raced to its highest levels since January this week as speculators piled into the market, betting on further disruptions in top producer Chile and firm demand from the biggest consumer China.

-

Tuesday, July 7th 2020 - 09:43 UTC

Chilean copper industry halts expansion to slow the spread of coronavirus among miners

Chile's Codelco has halted work on a multibillion-dollar project to extend the life of its El Teniente mine as the copper producer strives to slow the spread of the coronavirus disease through its workforce, the state-owned mining company said.

-

Friday, June 26th 2020 - 09:40 UTC

Chile suspends copper refinery and foundry at giant mine following Covid-19 19 deaths

Chilean copper miner Codelco said on Thursday it was suspending refinery and foundry operations at its sprawling Chuquicamata division to prevent further spread of the new coronavirus.

-

Monday, June 15th 2020 - 08:18 UTC

Chilean copper miners warn of alarming increase in Covid-19 cases and threaten to walk off the job

Chilean copper miners' unions called on Sunday for a re-evaluation of the operational continuity plans of the country's biggest miners during what they said was an “alarming” increase in coronavirus cases among workers.

-

Thursday, May 7th 2020 - 13:04 UTC

Chile anticipates a glut of some 200.000/300.000 tons of copper in 2020

The global copper market is headed for a surplus of between 200,000-300,000 tons in 2020, the head of the miner Antofagasta told Chilean media, with operation halts at some mines offsetting depressed demand due to the coronavirus pandemic.

-

Wednesday, January 8th 2020 - 08:55 UTC

Copper price unlikely to rebound in 2020 forecasts Chile's mining union

The copper price is unlikely to rebound in 2020 even if trade tensions between the United States and China subside, the head of Chile mining trade union Sonami said on Tuesday.

-

Tuesday, November 19th 2019 - 08:34 UTC

Chile's GDP expands 3.3% in 3Q, but prospects for 4Q are discouraging

Chile's gross domestic product grew 3.3 percent in the third quarter of 2019 compared with a year earlier, the central bank said on Monday. The market had predicted relatively strong growth during the July through September period, citing improving prospects for the country's all-important mining industry.