MercoPress. South Atlantic News Agency

Tag: Euro

-

Saturday, May 8th 2010 - 01:42 UTC

EU Full Support for Euro (and Greece) to Fight Contagion: Creates Stabilization Mechanism

Leaders of the 16 EU member states that use the Euro have approved a 110 billion Euro loan to Greece to prevent its debt crisis from spreading. European Commission President José Manuel Barroso said the Eurozone would do whatever it took to safeguard Greece's financial stability. In return for the three-year loan, Athens must cut public spending.

-

Friday, May 7th 2010 - 05:33 UTC

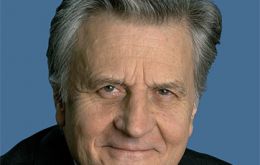

ECB Leaves Euro Policy Unchanged; European Leaders Set to Approve Greek Rescue

European Central Bank president Jean-Claude Trichet faced down pressure for new moves to shore up the weakest Eurozone countries, but kept options open even as he said Spain and Portugal were “not Greece”.

-

Tuesday, May 4th 2010 - 05:48 UTC

European Central Bank Beefs Greek Rescue-Plan; Takes “Junk” Bonds as Collateral

The European Central Bank (ECB) has moved to shore up the €110 billion EU/IMF rescue of Greece by offsetting the impact of the “junk” rating on the country’s debt.

-

Tuesday, May 4th 2010 - 05:29 UTC

German Cabinet Approves Contribution to Greek Bail Out

Germany's cabinet has approved its contribution to the Eurozone and IMF bailout of Greece. The German parliament is set to pass the legislation later this week to allow its loan—worth 22.4 billion Euros over three years—to be paid.

-

Thursday, April 29th 2010 - 06:34 UTC

Europe’s Financial Seism Reaches Spain: S&P Downgrades Credit Rating

International credit rating agency Standard and Poor's downgraded on Wednesday Spain's credit rating from “AA+” to “AA” with a negative outlook. The move comes a day after S&P gave Greek bonds a junk rating and lowered Portugal's credit rating from “A+” to “A-”.

-

Wednesday, April 28th 2010 - 18:18 UTC

IMF Warns of Greek Crisis Contagion; Germany Reluctant to Support Aid

The head of the International Monetary Fund has warned that the crisis in Greece could spread throughout Europe. Dominique Strauss-Kahn said that every day lost in resolving Greece's problems risks spreading the impact “far away”.

-

Wednesday, April 28th 2010 - 03:18 UTC

Delayed Planned Bailout Forcing Greece Closer to Technical Default

Shares across the globe fell sharply after German chancellor Angela Merkel said bond investors in Greece may have to take a hit even if a bail-out is agreed. With Merkel facing increased domestic opposition to the planned bailout and with elections imminent she has been talking tough, demanding Greece pay higher interest on any money it borrows than was originally agreed.

-

Tuesday, April 27th 2010 - 06:08 UTC

Brazil will Impose Import Levies to Face “Cheap” US Dollar, Unless Accord is Reached

Brazil’s government may take additional steps to limit gains in the local currency Real should advanced economies favor policies that keep their currencies weak, Finance Minister Guido Mantega said.

-

Saturday, April 24th 2010 - 01:32 UTC

Could the Greek Crisis Spell the End of the Euro as a Currency?

If Greece was to default it would effectively spell the end of the Euro as a currency, according to Royal Bank of Scotland's (RBS) strategist and chief European economist Jacques Cailloux.

-

Saturday, April 24th 2010 - 00:53 UTC

First Tremors of Euro Seism: Greece Asks for Financial Rescue Package

Greece has formally asked for the activation of an EU-IMF financial rescue package to help pull the debt-ridden economy out of its crisis. It had hoped that just the promise of EU support, agreed last month, would have been enough to reassure markets and help its recovery.