MercoPress. South Atlantic News Agency

Tag: Greece

-

Friday, May 7th 2010 - 05:36 UTC

Greek Default “Is Not an Option” and “Never Has Been” Says IMF

A default by Greece on its debt obligations is not and has never been an option, a spokeswoman for the International Monetary Fund (IMF) said on Thursday. A Greek “default is not on the table, has not been on the table” insisted IMF director of external relations Caroline Atkinson.

-

Friday, May 7th 2010 - 05:33 UTC

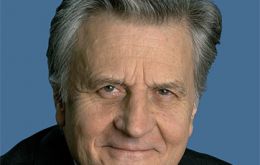

ECB Leaves Euro Policy Unchanged; European Leaders Set to Approve Greek Rescue

European Central Bank president Jean-Claude Trichet faced down pressure for new moves to shore up the weakest Eurozone countries, but kept options open even as he said Spain and Portugal were “not Greece”.

-

Friday, May 7th 2010 - 00:47 UTC

Greek Contagion Threatens South Europe and UK Banks Warns Rating Agency

Banks in the United Kingdom and Europe risk their credit ratings being damaged because of “contagion” from Greece's debt crisis, a ratings agency has warned. Moody's said banking systems faced “very real, common threats” if doubts were raised about their governments' abilities to pay debts. It referred specifically to UK, Irish, Italian, Portuguese and Spanish banking systems.

-

Friday, May 7th 2010 - 00:38 UTC

Greece Shocked by Riot Deaths; Parliament Approves Draconian Saving Reforms

Greece's parliament approved Thursday the hefty cuts and reforms proposed by the government to address the country's financial crisis. Members voted 172-121 to pass the bill, which includes tax rises and cuts in pensions and public sector bonuses. Police used tear gas to disperse protestors who rallied outside. On Wednesday, three bank workers died in a petrol bomb attack as demonstrations over the planned austerity measures turned violent.

-

Wednesday, May 5th 2010 - 06:35 UTC

Greek Aid Package Hard to Sell: Stock Markets World Wide Fall Sharply

Stock markets fell sharply Tuesday as concerns about high levels of European government debt continue to shake investor confidence. The Euro fell to a 13-month-low against the dollar, dropping to 1.3004, after earlier slipping below the 1.30 mark.

-

Tuesday, May 4th 2010 - 05:48 UTC

European Central Bank Beefs Greek Rescue-Plan; Takes “Junk” Bonds as Collateral

The European Central Bank (ECB) has moved to shore up the €110 billion EU/IMF rescue of Greece by offsetting the impact of the “junk” rating on the country’s debt.

-

Tuesday, May 4th 2010 - 05:29 UTC

German Cabinet Approves Contribution to Greek Bail Out

Germany's cabinet has approved its contribution to the Eurozone and IMF bailout of Greece. The German parliament is set to pass the legislation later this week to allow its loan—worth 22.4 billion Euros over three years—to be paid.

-

Monday, May 3rd 2010 - 02:24 UTC

Euro Zone and IMF Agree to 110 Billion Euro Aid for Greece; Summit in Brussels

Euro zone members and the IMF have agreed to a 110 billion Euro (146.2 billion US dollars) three-year bailout package to rescue Greece's embattled economy. In return for the loans, Greece will make major austerity cuts which Prime Minister George Papandreou said involved “great sacrifices”.

-

Thursday, April 29th 2010 - 06:34 UTC

Europe’s Financial Seism Reaches Spain: S&P Downgrades Credit Rating

International credit rating agency Standard and Poor's downgraded on Wednesday Spain's credit rating from “AA+” to “AA” with a negative outlook. The move comes a day after S&P gave Greek bonds a junk rating and lowered Portugal's credit rating from “A+” to “A-”.

-

Wednesday, April 28th 2010 - 18:18 UTC

IMF Warns of Greek Crisis Contagion; Germany Reluctant to Support Aid

The head of the International Monetary Fund has warned that the crisis in Greece could spread throughout Europe. Dominique Strauss-Kahn said that every day lost in resolving Greece's problems risks spreading the impact “far away”.