MercoPress. South Atlantic News Agency

Tag: IMF

-

Saturday, May 28th 2011 - 07:24 UTC

Even if US tightens liquidity, hot money to emerging economies will continue

Capital flows to emerging markets won’t significantly slow when the US Federal Reserve ends its bond-purchasing program known as quantitative easing, said Olivier Blanchard, chief economist at the IMF.

-

Wednesday, May 25th 2011 - 07:00 UTC

BRIC countries slam Europe’s ‘obsolete grip’ on the IMF top job

Top emerging economies joined forces to slam Europe's “obsolete” grip on the IMF top job, even as France's finance minister appeared to strengthen her lead in the race to replace Dominique Strauss-Kahn.

-

Monday, May 23rd 2011 - 06:01 UTC

Mexico Casterns throws his hat into the IMF MD election ring

Mexico central bank Governor Agustin Carstens will be presented as a candidate for managing director of the IMF, the Finance Ministry said in an e-mailed statement Sunday.

-

Sunday, May 22nd 2011 - 12:32 UTC

European powers endorse French minister Lagarde as next IMF chief

European leaders raced Saturday to nominate a successor for fallen IMF chief Dominique Strauss-Kahn before a G8 summit in France next week, with French Economy Minister Christine Lagarde in pole position.

-

Saturday, May 21st 2011 - 10:15 UTC

IMF should have a new Managing Director by June 30

The International Monetary Fund said on Friday that it is scheduled to complete the process of selecting a new managing director by June 30.

-

Saturday, May 21st 2011 - 09:45 UTC

Lipsky calls for continued support for ‘shaky’ economies in Europe

The global economic recovery is accelerating but remains vulnerable to setbacks said IMF acting Managing Director John Lipsky said as he urged continued international support for shaky economies in Europe.

-

Thursday, May 19th 2011 - 22:22 UTC

DSK granted bail and formally indicted; will appear in court June 6

Dominique Strauss-Kahn on Thursday was granted bail by a judge in a New York court, after being formally charged with trying to rape a hotel maid. Strauss-Kahn had earlier resigned as the International Monetary Fund's boss.

-

Thursday, May 19th 2011 - 07:36 UTC

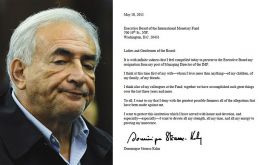

Strauss-Kahn resigns from IMF; defence lawyer presents new plea for bail

International Monetary Fund chief Dominique Strauss-Kahn has resigned following allegations he sexually assaulted a hotel maid in New York. In a statement, Mr Strauss-Kahn, 62, said he had already informed the executive board of his intention to step down “with immediate effect”.

-

Wednesday, May 18th 2011 - 07:10 UTC

US says IMF should designate an interim Managing Director

Dominique Strauss-Kahn is “not in a position to run” the International Monetary Fund after his arrest over an alleged sexual assault, US Treasury Secretary Timothy Geithner has said. He added IMF's executive board should designate an interim head.

The alleged assault on a maid happened at New York's luxury Sofitel hotel on 14 May. -

Tuesday, May 17th 2011 - 15:42 UTC

Brazil insists with an emerging economy Managing Director for the IMF

Brazil’s former Foreign Affairs minister Celso Amorim said that the next IMF Managing Director must come from an emerging economy if Dominique Strauss-Kahn, currently in custody in New York on alleged rape charges finally looses his job.