MercoPress. South Atlantic News Agency

Tag: Oilprice.com

-

Saturday, April 25th 2015 - 06:33 UTC

Oil price war may benefit both US Shale and Saudi Arabia

Even as financial commentators on CNBC are starting to come around to the idea of a bottom in oil prices, the key question for US oil producers remains one of timing. How long will the oil price slump last? Is this a relatively short term event like 2008, or a longer term slump like the one in the mid 1980’s?

-

Monday, April 20th 2015 - 06:57 UTC

Has the U.S. reached “peak oil” at current price levels?

The United States Energy Information Agency once again capitulated on the myth that rig counts don't matter and the productivity of wells would largely offset, leaving the industry on a continuous path to higher output. The current consensus of 500,000 B/D additional growth in 2015 US production now appears very much at risk.

-

Thursday, April 2nd 2015 - 08:08 UTC

Can Argentina capitalize on its vast shale reserves?

Argentina, once a regional energy leader, is now better known for financial busts and bombastic politicians than hydrocarbons prospects. Still, with a resource potential both vast and untapped, the nation has never been far from energy investors' minds. The question today is just how much Argentina is willing to change and how this plays into a low oil price environment that is already negatively impacting investment elsewhere.

-

Thursday, March 5th 2015 - 13:05 UTC

Here's what will send oil prices back up again

Oil's rapid decline since August of last year has been dramatic. To listen to some commentators you would also think it is unprecedented and irreversible. Those claiming that oil will continue to fall from here and remain low for evermore, however, are flying in the face of both history and common sense. The question we should be asking ourselves is not if oil prices will recover, but when they will.

-

Thursday, February 26th 2015 - 17:30 UTC

Is oil returning to 100 dollars or dropping to 10?

If you have been following the price of oil over the last few months, the chances are you're a little confused. On the one hand you have the likes of A. Gary Shilling who, in this Bloomberg article, loudly trumpets the prospect of oil at $10/Barrel, and on the other there is T. Boone Pickens, who, at the end of last year was predicting a return to $100 within 12-18 months.

-

Wednesday, February 25th 2015 - 16:41 UTC

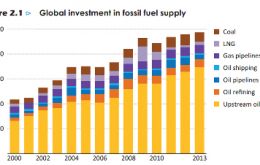

The easy oil is gone so where do we look now?

In 2008, Canadian economist Jeff Rubin stunned the oil market with a bold prediction: With the world economy growing at 5% a year, oil demand would grow with it, outpacing supply, thus lifting the oil price from $147 to over $200 a barrel.

-

Friday, February 20th 2015 - 04:51 UTC

Why oil prices must go up

It may be difficult to look beyond the current pricing environment for oil, but the depletion of low-cost reserves and the increasing inability to find major new discoveries ensures a future of expensive oil.

-

Wednesday, February 11th 2015 - 15:31 UTC

Arctic oil on life support

Oil companies have eyed the Arctic for years. With an estimated 90 billion barrels of oil lying north of the Arctic Circle, the circumpolar north is arguably the last corner of the globe that is still almost entirely unexplored.

-

Friday, February 6th 2015 - 02:11 UTC

Rise of the vulture investing class

The oil markets are showing some life, having rallied 11% over a two-day period. But if a bigger rebound is not around the corner, it won’t just be oil companies that will be feeling the pain: their lenders will also face some steep losses if drillers can’t come up with the cash to cover debt payments.

-

Tuesday, January 27th 2015 - 06:50 UTC

Oil Prices Changing The Face Of Global Geopolitics

In a documentary that aired recently on the Canadian Broadcasting Corporation's popular The Fifth Estate program, an allegory of Vladimir Putin was presented. The wily Russian president was described growing up in a shabby St. Petersburg apartment, where he would often corner rats.