MercoPress. South Atlantic News Agency

“Grain prices are more linked to the US dollar than to food demand”

Melconian confirmed a 48-month massive outflow of dollars from Argentina

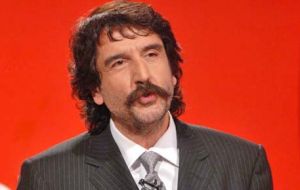

Melconian confirmed a 48-month massive outflow of dollars from Argentina “Saving in US dollars or in soybeans is the same” cautioned Argentine economist Carlos Melconian, who argued that “grain and oilseed prices are more linked to the value of the dollar than to demand for food produce”.

The former Argentine central bank staff member and head of a renowned consulting firm in Buenos Aires forecasted that “once the dollar begins to strengthen, the price of grains and oilseed will debilitate”.

“A strong dollar is synonymous of cheap commodities and a weak dollar of expensive commodities”, added Melconian who anticipated that a strong dollar is closely linked to the interest rate and once the rate begins to climb and the greenback becomes stronger, “commodities prices will weaken and the agro-dollars system (on which the current foreign trade of Argentina is based) will begin to debilitate”.

Melconian pointed out that when you look to long term tendencies “it can be seen that a very relevant international demand has been born and when the world detects these opportunities, a very significant supply is generated”.

Precisely “Argentina and Brazil detected that niche and that is why they are producing so much more”

When asked about the outflow of dollars from Argentina, Melconian said that “for the last 48 months dollars have been leaving Argentina”. He described the situation as “one of the major outflows of capital that I can remember of as an economist, but it goes unfelt because of the massive inflow of agro-dollars”.

More specifically on the performance of the Argentine economy, Melconian said that economic activity in certain sectors “is decelerating into massive consumption” and warned that it’s not only cars and plasma television sets, “the Central bank will have to be careful and very active to compensate the outflow of capital”.

Finally regarding the current world scenario Melconian said that “if the United States goes into debt default, forget it the whole economy blows into pieces”

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!