MercoPress. South Atlantic News Agency

Tag: Carlos Melconian

-

Tuesday, October 18th 2016 - 10:31 UTC

Argentina lowers interest rates for businesses as inflation tends to subside

Argentina's main state-run bank said it lowered its headline interest rates for loans to businesses on Monday amid expectations that inflation will begin to slow in Latin America's third-largest economy, a move that will help put credit back within firms' reach. Banco Nacion, the country's largest financial institution and which also acts as a development bank, set its annual nominal reference rate for business loans at 27%, down from 32%.

-

Monday, September 12th 2016 - 07:35 UTC

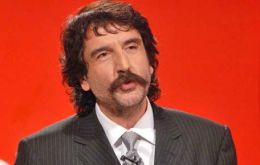

“President Macri is a normal person, has a normal head and common sense”

“The president we have now is normal, he has common sense and he wants to make the country normal and sooner than later, we'll be there; he has a normal world in his head”, said Carlos Melconian, head of Argentina's Bank of the Nation in reference to president Mauricio Macri, during a conference in Montevideo where he was invited to talk about “Argentina, the new rules of the game and their impact for Uruguay”,

-

Thursday, February 28th 2013 - 06:04 UTC

Ninety consecutive months of two-digit inflation in Argentina

Two-digit inflation in Argentina has reached 90 consecutive months, according to economist Carlos Melconian who added that since 2001 the prices’ increase in the country has averaged 500%.

-

Wednesday, October 26th 2011 - 15:26 UTC

Argentina floods the market with dollars to control money speculation

The Argentine Central Bank (BCRA) issued a special decree so that all export revenues generated by both mining and energy sectors remain in Argentina to be negotiated at the local foreign exchange market.

-

Tuesday, October 25th 2011 - 20:45 UTC

The Argentine economy is “a time-bomb ticking” warns economist

A ‘time bomb ticking’ is how economist Carlos Melconian described the current economic situation in Argentina in spite of all the production and consumption ‘records’. Melconian argues that Argentina is travelling through an ‘anaesthetic path’ which overshadows reality.

-

Saturday, September 3rd 2011 - 07:40 UTC

Argentine August inflation at 2% pushed by food prices, say private estimates

A surge in fresh food prices has pushed Argentina’s August consumer inflation to one of the highest of the year, 2% over the previous month, according to private consultant estimates and published in the Buenos Aires press.

-

Friday, July 15th 2011 - 06:09 UTC

“Grain prices are more linked to the US dollar than to food demand”

“Saving in US dollars or in soybeans is the same” cautioned Argentine economist Carlos Melconian, who argued that “grain and oilseed prices are more linked to the value of the dollar than to demand for food produce”.