MercoPress. South Atlantic News Agency

China aids Argentina: a billion dollars in Yuan pledged by end of the year

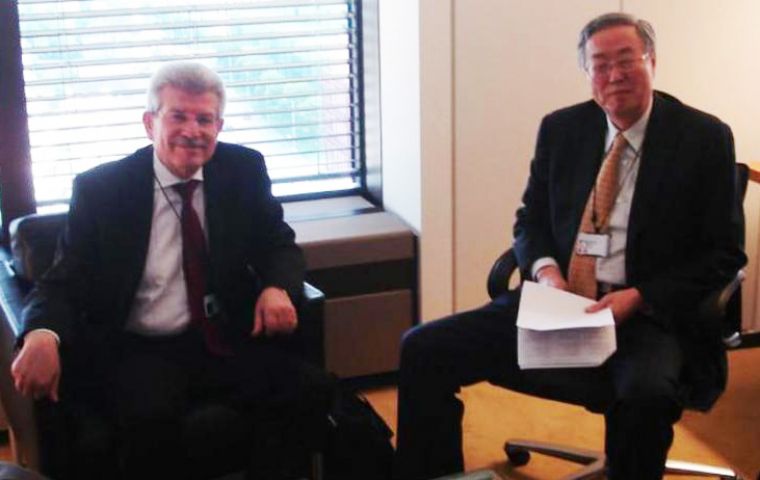

The announcement from the Argentine central bank was made following a meeting of Fabrega with his Chinese counterpart Zhou Xiaochuan in Basilea

The announcement from the Argentine central bank was made following a meeting of Fabrega with his Chinese counterpart Zhou Xiaochuan in Basilea Argentina's central bank chief, Juan Carlos Fabrega, met his Chinese counterpart Zhou Xiaochuan in Basilea, Switzerland on Sunday to discuss how a currency swap worth billions of dollars will be put into action, the Argentine monetary authority said.

The swap will allow Argentina to bolster its foreign reserves or pay for Chinese imports with the Yuan currency at a time weak export revenues and an ailing currency have put Argentina's foreign reserves under intense pressure.

Buenos Aires daily La Nacion reported that the Cristina Fernandez government would receive a first tranche of yuan worth one billion dollars before the end of the year, without saying how it obtained the information.

It would be part of a loan worth a total 11bn signed by President Cristina Fernandez and her Chinese counterpart Xi Jinping in July, shortly before Argentina was declared in default on its debt for a second time in 12 years.

The agreement has been praised by the government as a “tool to guarantee stability in Argentina’s reserves” in times when the Central Bank reserves total around 28,400 million dollars.

In its statement, the Argentine Central Bank made no reference to the timetable.

Argentina's latest default came after a US court blocked a coupon payment to holders of its performing debt because of a legal fight with U.S. investment funds that rejected the bond swaps following the country's record 2002 default.

“During the meeting, the head of the People's Bank of China conveyed to Fabrega his country's support to Argentina in its dispute with bondholders in a New York Court,” Argentina's central bank said in a statement.

Cristina Fernandez's government has imposed stringent import and capital controls to safeguard the dwindling reserves, now at around eight-year lows, which it needs to pay its debts.

The bankers met at the bimonthly meeting of the Bank for International Settlements (BIS), attended by 50 central bank heads from around the world.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsBorrowing money and reneging on the debt to US hedge funds is one thing, doing the same to China is something completely different..........I can see one of Maximo K's fingers appearing in someone's chop suey takeaway in a few years time.

Sep 08th, 2014 - 09:30 am 0Beggars, beggars and nothing but beggars. Did you of the Chin supply the KY? All you campora's are too young and stupid to understand the level of control you are entering. Asian financial colonization........lol. Have you noticed how many people in BsAs city are taking Chinese language lessons......by Chinese?

Sep 08th, 2014 - 09:31 am 0If she grinned any wider she would crack up..lol

Sep 08th, 2014 - 10:03 am 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!