MercoPress. South Atlantic News Agency

US confident of EU sanctions on Venezuela, if political dialogue fails; Russia main trader of the country's oil

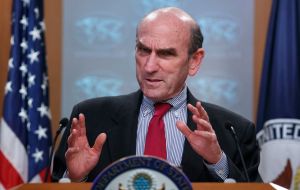

Abrams said EU nations were waiting for the outcome of talks between Venezuela’s government and the opposition, with no signs that Maduro was about to step down

Abrams said EU nations were waiting for the outcome of talks between Venezuela’s government and the opposition, with no signs that Maduro was about to step down  “If the negotiations fail they will impose sanctions,” Abrams said, who is skeptical whether negotiations would proceed

“If the negotiations fail they will impose sanctions,” Abrams said, who is skeptical whether negotiations would proceed Washington's envoy for Venezuela said on Thursday he was hopeful that the European Union will impose sanctions against Caracas in the coming months and the United States was examining more measures to pressure President Nicolas Maduro to step down.

US envoy Elliott Abrams told reporters that Maduro's government was increasingly relying on Russian oil firm Rosneft for financial support, but Rosneft's purchases and sales of Venezuelan oil did not violate US sanctions at this time, he added.

Abrams said European nations were waiting to see the outcome of talks between Venezuela’s government and the opposition, with no signs that Maduro was about to step down.

“If the negotiations fail they will impose sanctions,” Abrams said, adding, “In our view that is probably a mistake because if they were imposing sanctions now... there would be a better chance for negotiations to succeed.”

Abrams was skeptical whether negotiations would proceed.

“The talks are in hiatus,” he said. “They have not met for several weeks and there is no date yet set” for talks to resume.

Maduro called off talks earlier in August after new U.S. sanctions were announced, meant to force him from power. The two sides had been meeting in Barbados in talks brokered by Norway.

Washington and most Western nations support Juan Guaido, the chief of the opposition-run National Assembly, who in January invoked the constitution to assume a rival presidency, arguing Maduro’s 2018 re-election was illegitimate.

Guaido was trying to determine whether Maduro was serious about a political compromise through negotiations, Abrams said.

“They’ve said since the beginning they don’t intend to let this get drawn out... without any conclusion,” Abrams said, referring to the opposition.

As the United States has stepped up sanctions against Maduro, his government has increasingly relied on Russian oil firm Rosneft for financial support, Abrams said.

Trading sources and Refinitiv Eikon data showed Rosneft became the biggest buyer of Venezuelan crude in July and the first half of August.

Russia and China have called U.S. sanctions against Venezuela unilateral and illegal.

“We believe Rosneft is buying that oil at a very significant discount from Venezuela and likely selling refined products at a very significant mark up,” said Abrams.

Venezuelan oil production was steadily declining, estimating it at roughly 800,000 barrels a day, down from 1.1 million earlier this year, he said.

It was too soon to say whether China’s National Petroleum Corp (CNPC), also a leading buyer of Venezuelan oil, had halted loadings in August amid U.S. threats of possible secondary sanctions, Abrams said.

China’s crude imports from Venezuela plunged 40% in July from the previous month, according to Chinese customs data.

“We will have to see what happens in August or September. We don’t have the data yet,” Abrams said. “It may be that CNPC no longer engages in it because it has global interests... but other Chinese companies pick up the slack,” he added.

Russia and China are taking oil as part of debt servicing agreements after lending Caracas money in previous years.

While Venezuela’s debt to Rosneft declined to around US$ 1 billion this year, Caracas still owed China roughly US$ 20 billion, he said.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!