MercoPress. South Atlantic News Agency

Economy

-

Thursday, January 28th 2010 - 05:24 UTC

Apocalyptic forecast about G-7 countries from investment advisor

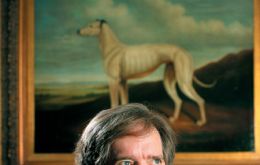

A top investment advisor has described Britain's economy as a 'must to avoid' and says 'gilts are resting on a bed of nitro-glycerine'. Bill Gross, manager of the world's biggest bond fund Pacific Investment Management Co made the comments as he warned investors to shy away from government debt, especially in the G7 industrialised nations.

-

Thursday, January 28th 2010 - 05:17 UTC

GM sells Saab to Dutch luxury car maker Spyker

Troubled Swedish carmaker Saab has been sold to Dutch luxury sport car maker Spyker. The sale was made by its current owners General Motors (GM) who said they had entered into a “binding agreement” to sell the iconic brand to Spyker.

-

Wednesday, January 27th 2010 - 15:16 UTC

Redrado conditions participation before congressional advisory committee

The ousted head of the Central Bank Martín Redrado demanded Tuesday Argentine President Cristina Fernández de Kirchner revoke the DNU emergency decree which she had issued in order to dismiss him from his post as the Central Bank governor.

-

Wednesday, January 27th 2010 - 15:13 UTC

It’s official: UK economy crawling out of its deepest recession

The United Kingdom has officially emerged from its longest and deepest recession on record, with figures showing the economy grew by 0.1% in the last quarter of 2009. The result brings an end to six consecutive quarters of shrinking output for the British economy.

-

Wednesday, January 27th 2010 - 14:40 UTC

US 2010 budget deficit estimated at 9.2% of GDP, second highest

The United States Congressional Budget Office, CBO released Tuesday its 10 year budget projections which includes a deficit for this fiscal year of 1.3 trillion US dollars, equivalent to 9.2% of GDP.

-

Wednesday, January 27th 2010 - 14:37 UTC

Record world unemployment in 2009: not much better this year, says ILO

The number of jobless worldwide reached nearly 212 million in 2009 following an unprecedented increase of 34 million compared to 2007, on the eve of the global crisis, the International Labour Office (ILO) said in its annual Global Employment Trends report released Tuesday in Geneva.

-

Wednesday, January 27th 2010 - 14:34 UTC

Beijing drastic decision to cap excessive lending shakes world markets

Asian markets suffered their biggest one-day losses in three months, as fears over planned limits on lending by banks in China unnerved investors already jumpy at proposed curbs on United States banks.

-

Monday, January 25th 2010 - 14:49 UTC

Chile and Argentina consolidate bilateral integration and cooperation

Chile announced that the “Integration and Cooperation” agreement with Argentina, which was stamped by Presidents Cristina Kirchner and Michelle Bachelet last October 30, became effective as of Friday January 22nd.

-

Monday, January 25th 2010 - 14:40 UTC

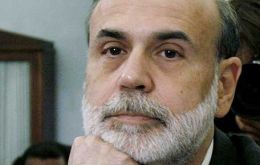

White House confident of Bernanke’s confirmation at the Federal Reserve

The White House says it is confident of Ben Bernanke's confirmation as Federal Reserve chairman for a second term.

-

Saturday, January 23rd 2010 - 15:44 UTC

Argentine courts ratify the freeze on use of Central Bank reserves

Argentina’s Federal Contentious Administrative Court Friday ratified the suspension on the use of the Central Bank foreign currency reserves to payout public debt, according to judicial sources in Buenos Aires.