MercoPress. South Atlantic News Agency

Economy

-

Friday, September 25th 2009 - 10:38 UTC

UK unions ready to challenge Jaguar and Land Rover restructuring

British unions have condemned plans by car giant Jaguar Land Rover to close one of its UK plants. The firm said it would decide next year whether to shut its factory at Castle Bromwich in the West Midlands, which makes Jaguars, or its site at Solihull, which makes Range Rovers.

-

Friday, September 25th 2009 - 10:34 UTC

British Chancellor tells bankers “the party is over”

Britain’s Chancellor of the Exchequer Alistair Darling has warned bankers that the party is over and they must realise the world has changed. He made the comments in a BBC interview before leaving for the G20 summit in Pittsburgh.

-

Friday, September 25th 2009 - 09:55 UTC

Pittsburgh G-20 summit kicks off with minor clashes in the streets

Trouble has flared as world leaders gathered Thursday in the US city of Pittsburgh for the G20 summit. Reports said riot police used pepper gas and fired rubber bullets at protesters on a march near the venue.

-

Friday, September 25th 2009 - 02:09 UTC

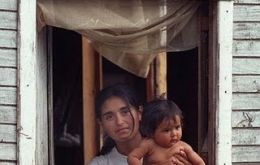

Catholic Church blasts “irritating” Argentine government numbers on poverty

Argentina’s Catholic Church considers “irritating” the argument that poverty had diminished in the country when it is plain evidence that this is not the case, “rather the contrary”. It is indignant for Argentina that the system should consider the excluded as “a variable of political success”.

-

Friday, September 25th 2009 - 00:58 UTC

MIT poverty investigation centre opens in Chile

The Jameel Poverty Action Lab (J-PAL) will open its new Latinamerican headquarters in Chile next Monday, Sept. 28. J-PAL is an organization that investigates poverty and is headquartered in Cambridge, Massachusetts at the Massachusetts Institute of Technology (MIT) Department of Economics.

-

Thursday, September 24th 2009 - 11:59 UTC

Argentina’s industrial production showing signs of recovery

Argentina's industrial production index in August rose 1.4% on the month, but was down 4.7% on the year, the Foundation for Latin American Economic Research, FIEL, said in a report released Wednesday.

-

Thursday, September 24th 2009 - 11:50 UTC

Beef export peak forecasted in Argentina for 2009

Argentine exports of refrigerated beef reached 34.923 tons in August equivalent to 131.2 million US dollars, according to official data provided by Senasa (Animal Health National Service).

-

Thursday, September 24th 2009 - 11:45 UTC

Chile’s fresh fruit exports hit by weak international markets

Weak international markets led to a 6% drop in the value of Chile’s fresh fruit exports this past 2008/2009 season, reported Fedefruta President Rodrigo Echeverría this week in Santiago.

-

Thursday, September 24th 2009 - 10:59 UTC

Peru blasts military expenditure and arms purchases in Latinamerica

Peruvian president Alan García demanded Wednesday that the Organization of American States, OAS, help contain the arms purchasing spree in Latinamerica, an issue that has created irritation and disputes among several countries of the region.

-

Thursday, September 24th 2009 - 10:53 UTC

Bank of England minutes reflect “uncertainty” and fears of inflation

Inflation in the United Kingdom has proved more stubborn than expected and is now no longer estimated to fall below 1% this autumn, according to minutes from the Bank of England's rate-setting committee. But there is still a lot of uncertainty about the economy and the impact of the ongoing reluctance of banks to lend.