MercoPress. South Atlantic News Agency

Economy

-

Saturday, May 16th 2020 - 07:54 UTC

Trump set to restore partial funding for WHO, to similar level of China's contribution

US President Donald Trump's administration is set to restore partial funding to the World Health Organization (WHO), Fox News reported late on Friday, citing a draft letter.

-

Saturday, May 16th 2020 - 07:49 UTC

Britain-EU round of post Brexit talks end with scant progress

Britain and the European Union urged each other on Friday to give ground in talks over a post-Brexit trade deal or risk failure in tetchy exchanges after the latest bout of bargaining ended with scant progress.

-

Saturday, May 16th 2020 - 07:44 UTC

An icon of US retail industry, J.C. Penney filed for bankruptcy protection

J.C. Penney Co Inc filed for bankruptcy protection on Friday with plans to permanently close some stores and also explore a possible sale, making it the latest brick-and-mortar retailer to crumble as prolonged store closures in response to the COVID-19 pandemic drive a final stake through long-troubled businesses.

-

Saturday, May 16th 2020 - 07:18 UTC

China calls on the US to “fulfill their financial obligations to the United Nations”

China on Friday issued a statement calling on all UN member states to “actively fulfill their financial obligations to the United Nations,” stressing that Washington owes the organization more than US$2 billion.

-

Friday, May 15th 2020 - 11:03 UTC

A Falklands' milestone: opening of Mount Pleasant airport 35 years ago

May 12 was the 35th anniversary of the opening of Mount Pleasant Airport in the Falkland Islands. A milestone that definitively changed the life and future of the Islands, helping to boost trade and tourism.

-

Friday, May 15th 2020 - 08:53 UTC

Latin America's two main economies with daily record virus cases, but also desperate to reopen activity

Brazil and Mexico on Thursday reported a record one-day rise in new coronavirus cases, just as leaders of both countries intensified attempts to reopen their economies even as the spread of the virus in Latin America is seemingly gathering pace.

-

Friday, May 15th 2020 - 08:52 UTC

Brazil lowers economic outlook to minus 4,7% in 2020; pre crisis recovery level will be reached in 2022

Brazil’s government lowered its 2020 economic outlook, forecasting a gross domestic product contraction of 4.7%, which would signal the country’s biggest economic crash in more than a century.

-

Friday, May 15th 2020 - 08:49 UTC

Next Monday Itaipu opens its spillway to help lift the drought stricken Parana river level

The world's largest operational hydroelectric dam, Itaipu Plant announced that starting next Monday, May 18, it will open its spillway to help Paraguay and Argentina, which are suffering from a drought and hence having problems transporting their grain harvest.

-

Friday, May 15th 2020 - 08:27 UTC

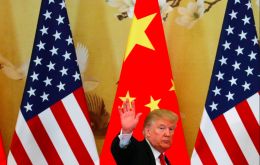

Trump not interested in speaking with president Xi and suggests cutting “whole relationship with China”

President Donald Trump signaled a further deterioration of his relationship with China over the novel coronavirus, saying he has no interest in speaking to President Xi Jinping right now and going so far as to suggest he could even cut ties with the world’s second-largest economy.

-

Friday, May 15th 2020 - 08:05 UTC

Trump administration issues Global Maritime Advisory guidelines for ship owners and insurers

The Trump administration on Thursday issued guidelines to help ship owners and insurers avoid the risks of sanctions penalties, standards that maritime players and a senior State Department official said were modified following months of discussions with industry.