MercoPress. South Atlantic News Agency

Tag: Brazilean Central Bank

-

Tuesday, February 28th 2012 - 05:02 UTC

Brazil will cut the benchmark interest rate “to less than 10%” this year

Brazilian central bank survey showing interest rate levels are inconsistent with the country’s inflation target won’t alter policy makers’ strategy of lowering borrowing costs further, bank President Alexandre Tombini said.

-

Saturday, February 11th 2012 - 07:42 UTC

Brazilean consumer prices increase 0.56% in January, fastest in nine months

Brazilian consumer prices rose at the fastest pace in nine months in January on higher transport, food and drink costs. Prices increased 0.56% from December, the national statistics agency said in a report distributed in Rio de Janeiro.

-

Wednesday, January 25th 2012 - 03:58 UTC

Brazil record foreign direct investment more than compensates current account deficit

Brazil posted a record-high current account deficit in 2011 on rising profit remittances by multinational companies and massive spending abroad by Brazilian tourists, but the deficit was more than covered by another record, this time for foreign direct investment, the central bank said Tuesday.

-

Monday, December 12th 2011 - 19:26 UTC

Economists downgrade Brazil’s growth estimates for this year and 2012

Brazilian bank economists cut the country’s growth estimate for this year to below 3%, (2.97%) according to a last week survey by the Central bank of over one hundred institutions and which was released Monday.

-

Thursday, December 1st 2011 - 06:02 UTC

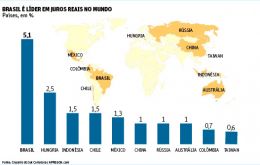

Brazil has the highest real interest rate among 40 leading economies

The Brazilian Central bank latest decision to lower the basic interest rate by half a percentage point to 11%, confirms Brazil leadership as the country with the highest real interest rates in the world. An honour it has held interruptedly for the last 23 months.

-

Wednesday, November 30th 2011 - 23:08 UTC

Brazil cuts basic rate by half a point to 11% and says inflation converging to target

Brazil’s central bank cut borrowing costs by half a point for a third straight meeting as a global economic slowdown threatens with a slump in domestic demand. The bank’s board voted on Wednesday unanimously to reduce the benchmark Selic rate to 11% from 11.5%, as had been anticipated by markets.

-

Wednesday, November 9th 2011 - 07:02 UTC

Brazil's credit growth slowing to a “sustainable pace”, says Central bank

Brazil’s credit growth is slowing to a sustainable pace and sufficient to feed domestic demand, said on Tuesday Luiz Pereira, the central bank’s director of international affairs.

-

Thursday, October 27th 2011 - 15:50 UTC

Brazilian central bank suggests ‘moderate’ cuts to interest rates

Brazil’s central bank said slowing global growth will have a large enough disinflation impact and allow policy makers to carry out “moderate” cuts to interest rates.

-

Tuesday, October 25th 2011 - 04:19 UTC

Inflation in Brazil slowing down for the first time in 14 months

Economists covering Brazil cut their 2012 inflation forecast for the first time in eight weeks, cementing expectations that the central bank will continue to cut interest rates.

-

Friday, October 7th 2011 - 05:30 UTC

Brazilian production feels the impact of cheap imports and global slowdown

Output at Brazil's mines and factories slowed in August, falling a seasonally adjusted 0.2% from July as production in the country's industrial sector suffered the impact of cheap imports and the sluggish global economy.