MercoPress. South Atlantic News Agency

Tag: holdout hedge funds

-

Friday, August 29th 2014 - 05:56 UTC

Argentina will only negotiate with all bondholders: no more piecemeal debt talks

Argentina's government ruled out further piecemeal debt talks with a small group of U.S. hedge funds (holdouts) and said the country needed to strike a deal with all bondholders including those which have rejected past restructuring agreements as a single group.

-

Wednesday, August 27th 2014 - 06:42 UTC

Singer recruits former Secretary of State Albright for its dispute with Argentina

Billionaire Paul Singer, founder and CEO of hedge fund Elliott Management Corporation has picked up some major political muscle to press his case in the long-running debt battle with Argentina, reports the New York Post.

-

Tuesday, August 26th 2014 - 06:42 UTC

Soros group and others file lawsuit against BONY over payments in Euros

A group of hedge funds, including George Soros’s Quantum Partners and J. Kyle Bass’s Hayman Capital, is seeking a 226 million Euro interest payment on Argentine bonds from Bank of New York Mellon, BONY, that was blocked by a United States judge last month.

-

Friday, August 22nd 2014 - 07:43 UTC

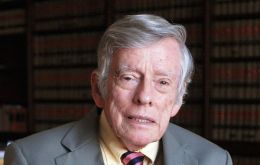

Argentina describes Griesa as 'ignorant' and lacking knowledge on democratic institutions

The Argentine government again blasted Judge Thomas Griesa for declaring 'illegal' the bill sent to Congress referred to the country's debt and creditors, and said the magistrate “ignores national sovereignty” and “ignores how democratic institutions function”.

-

Friday, August 22nd 2014 - 07:33 UTC

European holders of swapped Argentine bonds willing to accept removal of the RUFO clause

European investors holding 5.2 billion dollars of restructured Argentine bonds are negotiating the removal of the Rights Upon Future Options (RUFO) clause that Argentina claims prevents them from negotiating with holdout funds, it was reported in the Buenos Aires media.

-

Friday, August 22nd 2014 - 07:17 UTC

Griesa leaves Argentina 'in contempt' ledge; warns any change of jurisdiction was 'lawless'

US District Judge Thomas Griesa declared on Thursday that an Argentine plan to change the 'jurisdiction' of restructured foreign debt was illegal, while resisting holdout investors' demands that Argentina be held in contempt of court for attempting to change the site of payment to Buenos Aires.

-

Thursday, August 21st 2014 - 08:30 UTC

Kicillof: “no change of NY jurisdiction, but a change of payment location”

Argentina's new plan to skirt U.S. courts and resume payment on defaulted bonds aims to protect creditors who participated in two debt restructurings, Economy minister Axel Kicillof said on Wednesday. But he also emphasized that the bill sent to Congress did not mean a 'change of jurisdiction' from New York but rather a change of payment 'location'.

-

Thursday, August 21st 2014 - 08:06 UTC

'A contempt of court does not apply to sovereign Argentina', says Capitanich

Anticipating what seems an imminent order of contempt-of-court by US Judge Thomas Griesa following Argentine President Cristina Fernández decision to push a bill to change the payment jurisdiction to Buenos Aires, Cabinet Chief Jorge Capitanich pointed out that as a “sovereign country” Argentina cannot end up in contempt despite Griesa’s warnings.

-

Thursday, August 21st 2014 - 07:07 UTC

Aurelius Capital brands Argentine leaders 'outlaws' for flouting US courts orders

One of two hedge funds that sued Argentina over defaulted bonds branded the country's leaders “outlaws” on Wednesday after Buenos Aires moved to shift its bond payment method.

-

Thursday, August 21st 2014 - 06:58 UTC

Italian bondholders' representative supports Argentina decision to change debt's jurisdiction

The Italian legal representative of Argentine bondholders, Tullio Zembo praised the Sovereign Public Debt Payment Law announced by President Cristina Fernandez, saying the decision to change the debt’s jurisdiction to Buenos Aires is “probably the most appropriate.”