MercoPress. South Atlantic News Agency

Tag: IMF

-

Monday, July 19th 2010 - 04:24 UTC

Positive sustained growth prospects for Latin America in 2010, forecasts IMF

The Latin American economy could grow by as much as 5% this year, more strongly than previously expected (4%), driven by Brazil's vigorous expansion, according to a senior International Monetary Fund official.

-

Monday, July 19th 2010 - 04:21 UTC

Portugal, Ireland, Greece, Spain, the Euro and now Hungary: who’s next?

The IMF and EU suspended a review of Hungary's funding program, set up in 2008 to save the country from financial meltdown, saying it must take tough action to meet targets for cutting its budget deficit.

-

Saturday, July 10th 2010 - 07:41 UTC

US no longer world’s great consumer; needs to target sustainable debt, says IMF

The US economy is recovering after the global economic crisis, but consumers and financial institutions remain cautious as weak housing markets, high unemployment, and risks in Europe remain a concern, the IMF staff said in a press conference that followed its annual review of the world’s largest economy.

-

Saturday, July 10th 2010 - 07:13 UTC

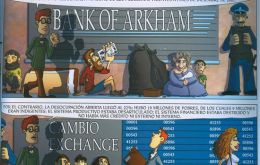

School comic strips to depict the turbulent IMF/Argentina relation

Argentina high school students are enjoying four comic strips, part of the official program, which satirizes the turbulent relation of the country with the IMF, presenting one of the works under the attractive name of “An intruder in the family”.

-

Wednesday, June 30th 2010 - 05:50 UTC

US dollar should be replaced by a more stable system, says UN report

The US dollar is an unreliable international currency and should be replaced by a more stable system, the United Nations Department of Economic and Social Affairs said in a report released Tuesday.

-

Friday, June 4th 2010 - 05:07 UTC

G-20 challenge: how to reduce deficits and not kill incipient economic recovery

Disagreements over how quickly to reduce inflated budget deficits and restore balance to the global economy risk will be one of the main issues to be addressed at the high-level Group of 20 talks this week in South Korea.

-

Tuesday, May 25th 2010 - 00:57 UTC

IMF bluntly tells Spain austerity and reform measures are not enough

The International Monetary Fund has raised fresh concerns about Spain's economy, saying “far-reaching” reforms are needed to ensure its recovery. It said the country faced “severe” challenges, including the need to urgently reform a “dysfunctional” labour market, and its banking sector.

-

Saturday, May 15th 2010 - 04:37 UTC

IMF Warns Developed Countries on “Urgent” Need to Cut Budget Deficits

The International Monetary Fund has warned developed nations they face an “urgent” need to cut their budget deficits. Its warning comes as a slew of European countries face public unrest over their attempts to do just that.

-

Wednesday, May 12th 2010 - 03:54 UTC

IMF: Euro Countries Must Focus on Cutting Deficits; Denies “Blanket Commitment”

European countries saddled with debt should focus on cutting deficits in the wake of policy makers' unprecedented efforts to contain the region's sovereign-debt crisis, said John Lipsky from the International Monetary Fund.

-

Monday, May 10th 2010 - 05:35 UTC

EU Reacts and Unveils Package of 962 Billion US Dollars to Bolster the Euro

European leaders unveiled an unprecedented loan package worth almost one trillion US dollars and a program of bond purchases in an attempt to bolster the Euro that has become highly vulnerable because of the Greek sovereign-debt crisis.