MercoPress. South Atlantic News Agency

Tag: interest rate

-

Thursday, May 22nd 2014 - 00:31 UTC

Fed minutes confirm a retreat from easy monetary policy; concerns regarding job creation

Federal Reserve policymakers last month began laying groundwork for an eventual retreat from easy monetary policy with a discussion of how to best control interest rates as they remove trillions of dollars from the financial system.

-

Wednesday, August 8th 2012 - 06:47 UTC

Poll shows deeper interest rates cuts expected from the Brazilian central bank

Weak economic growth will likely prompt Brazil's central bank to cut interest rates deeper than previously expected this year, a weekly central bank survey of economists showed on Monday.

-

Tuesday, December 13th 2011 - 22:27 UTC

Chile leaves benchmark interest rate unchanged for sixth straight month: 5.25%

Chile’s central bank kept its benchmark interest rate unchanged for the sixth straight month at 5.25%, as slowing global growth shows little sign of damping inflation and demand in the world’s biggest copper producer.

-

Thursday, December 1st 2011 - 06:02 UTC

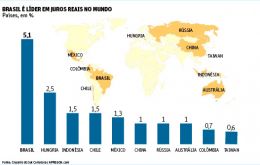

Brazil has the highest real interest rate among 40 leading economies

The Brazilian Central bank latest decision to lower the basic interest rate by half a percentage point to 11%, confirms Brazil leadership as the country with the highest real interest rates in the world. An honour it has held interruptedly for the last 23 months.

-

Thursday, October 27th 2011 - 15:50 UTC

Brazilian central bank suggests ‘moderate’ cuts to interest rates

Brazil’s central bank said slowing global growth will have a large enough disinflation impact and allow policy makers to carry out “moderate” cuts to interest rates.

-

Thursday, September 8th 2011 - 22:13 UTC

Bank of England won’t extend liquidity program; leaves rates at minimum

UK interest rates have been held at a record low of 0.5% by the Bank of England's Monetary Policy Committee (MPC). Concerns about the strength of the UK economic recovery meant economists had expected rates to remain unchanged as they have been since March 2009.

-

Thursday, July 21st 2011 - 10:09 UTC

Brazil raises the basic rate to 12.50%, but confident it can tame inflation

Brazil’s central bank announced late Wednesday the fifth straight increase in its benchmark Selic rate by a quarter points to 12.5%, a decision much anticipated by the market and geared to combat high inflation, which is running at a six-year high, 6.75% above the government’s upper target of 6.5%.

-

Saturday, July 16th 2011 - 07:08 UTC

Chilean central bank leaves benchmark rate unchanged at 5.25%

The Chilean central bank kept its benchmark interest rate unchanged this week for the first time since January as signs of slower growth abroad and a moderation in domestic output and demand provided space to delay additional increases.

-

Monday, June 27th 2011 - 06:15 UTC

Central banks must raise interest rates to control inflation, says BIS

Central banks need to start raising interest rates to control inflation and may have to act faster than in the past according to the Bank of International Settlements.

-

Thursday, June 9th 2011 - 19:24 UTC

Brazil hikes basic rate to 12.25% and further increases can be expected

Brazil's central bank increased late Wednesday its benchmark interest rate for the fourth straight meeting after consumer prices exceeded the upper limit of its target range for the first time since 2005.