MercoPress. South Atlantic News Agency

Tag: MSCI

-

Friday, June 25th 2021 - 16:09 UTC

Argentina downgraded to “independent market” in MSCI ratings

MSCI, formerly Morgan Stanley Capital International, a US company that measures stock performances worldwide to advise potential investors on their decisions, has removed Argentina from their various listings and added it to the dishonourable category of “stand-alone” economies.

-

Wednesday, June 24th 2020 - 11:57 UTC

MSCI warns that the Argentina Index could be removed from the MSCI Emerging Markets Index

MSCI Inc, the world’s largest index provider, warned on Tuesday that the MSCI Argentina Index could be removed from the MSCI Emerging Markets Index should it become harder for foreign investors to access its stock market.

-

Thursday, January 16th 2020 - 08:54 UTC

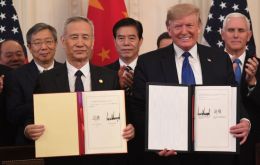

World stocks at record high after US and China sign a deal to defuse the trade war

World stocks inched to a record high on Thursday after the United States and China signed a deal to defuse their 18-month trade war, which has weighed on global economic growth and hampered investments.

-

Wednesday, June 19th 2019 - 09:57 UTC

Latam stocks and currencies surged on Tuesday on favorable global news

Latin American stocks and currencies surged on Tuesday with a dovish boost from the European Central Bank and positive headlines from the U.S.-China trade tensions boosting sentiment.

-

Saturday, March 23rd 2019 - 09:06 UTC

Temer's arrest and military pensions' reform brings down Brazilian stock market and weakens currency

Brazilian stocks fell sharply on Friday as the arrest of the country’s former president, Michel Temer, sparked worries that government debate over key fiscal reforms may be delayed.

-

Tuesday, December 4th 2018 - 08:58 UTC

Benchmark emerging-market stocks index waiting for Brazil's Bolsonaro

Brazil’s presence in the benchmark emerging-market stock index could rise again should incoming President Jair Bolsonaro deliver on his promises to shore up the finances of Latin America’s largest economy, according to MSCI Inc chief executive Henry Fernandez.

-

Wednesday, June 20th 2018 - 08:31 UTC

Global Index decides on Wednesday if it includes Argentina and Saudi Arabia

Global index compiler MSCI is considering including Argentina and Saudi Arabia in its emerging market indexes at a review of its widely-tracked benchmark on Wednesday, and could potentially announce candidates that may join its indexes in future.