MercoPress. South Atlantic News Agency

World stocks at record high after US and China sign a deal to defuse the trade war

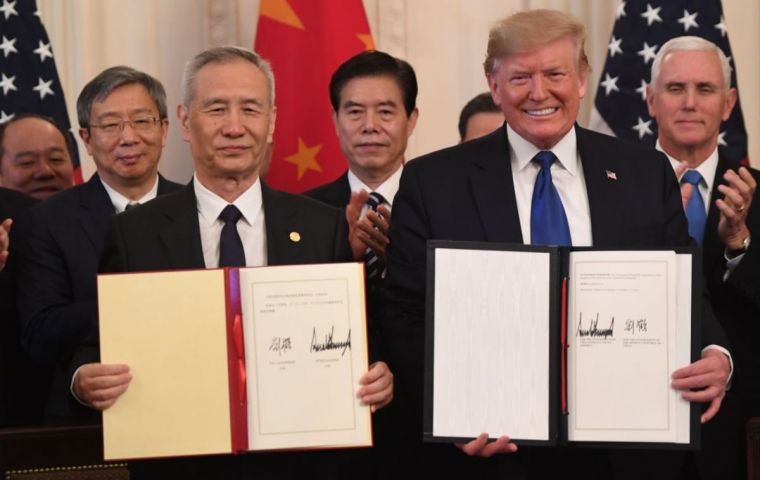

Donald Trump and Vice Premier Liu He on Wednesday signed a deal that will roll back some tariffs and see China boost purchases of U.S. goods and services

Donald Trump and Vice Premier Liu He on Wednesday signed a deal that will roll back some tariffs and see China boost purchases of U.S. goods and services  The S&P 500 closed at a record high of 3,289.3 points, up 0.19per cent, with gains fairly small after the market has rallied for months on hopes of a deal.

The S&P 500 closed at a record high of 3,289.3 points, up 0.19per cent, with gains fairly small after the market has rallied for months on hopes of a deal. World stocks inched to a record high on Thursday after the United States and China signed a deal to defuse their 18-month trade war, which has weighed on global economic growth and hampered investments.

MSCI's broadest index of world stocks firmed 0.04per cent in early trade after closing at record level on Wednesday while its index on Asia-Pacific shares outside Japan rose 0.10per cent.

Japan's Nikkei rose 0.14per cent while Australian shares were 0.6per cent higher.

U.S. President Donald Trump and Chinese Vice Premier Liu He on Wednesday signed a deal that will roll back some tariffs and see China boost purchases of U.S. goods and services by US$200 billion over two years.

The deal does not address structural economic issues that led to the trade conflict, and does not fully eliminate the tariffs while the US$200 billion purchase targets look daunting to achieve. Yet it reduced uncertainties that have beset financial markets.

“Whether somebody looks at this as big progress or little progress, it is something tangible and so the arrow is pointing in a direction that the market is comfortable with,” said Chuck Carlson, chief executive officer of Horizon Investment Services at Hammond, Indiana in the United States.

The S&P 500 closed at a record high of 3,289.3 points, up 0.19per cent, with gains fairly small after the market has rallied for months on hopes of a deal.

The index was dragged down by fall in financial shares following downbeat earnings from Bank of America and Goldman Sachs .

“While the trade deal has provided a relief, there wasn't any positive surprises for markets. For shares to rise further, we need more evidences of improvement in the real economy and earnings,” said Hirokazu Kabeya, chief global strategist at Daiwa Securities.

Bond yields dropped as a boost from the trade deal failed to offset pressure from low U.S. producer price inflation data, which highlighted persistently low inflationary pressure.

The price index rose less than expected in December to cap 2019 with rise of 1.3per cent, lowest since 2015.

The 10-year U.S. Treasuries yield slipped to one-week low of 1.786per cent compared with a high of 1.900per cent last Thursday.

Weak inflation was evident also in UK where consumer price inflation slowed to 1.3per cent, its slowest rate in three years. The data fanned bets the Bank of England will cut interest rates at the end of this month, bringing Britain's currency under further pressure briefly.

The Swiss franc held firm, having rising to its strongest against the dollar in over a year and its highest against the euro in almost three years after the United States added Switzerland to its watch-list of currency manipulators.

In contrast, the Chinese Yuan hovered just below its 5-1/2-month high touched earlier this week after Washington dropped its currency manipulator label on China.

Coupled with the trade deal, warmer ties between the two countries are seen as positive for the Chinese economy and its currency. The offshore Yuan stood at 6.8860 to the dollar , near Tuesday's high of 6.8662.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!