MercoPress. South Atlantic News Agency

Tag: S&P 500

-

Thursday, December 3rd 2020 - 08:29 UTC

The S&P 500 index at record high, while US congress debates a relief for the US economy

The S&P 500 climbed to a record high close on Wednesday and the Nasdaq Composite Index dipped as investors weighed upbeat vaccine developments and a potential coronavirus fiscal package against a bleak private jobs report.

-

Tuesday, November 17th 2020 - 09:50 UTC

Dow Jones in record highs on news of another promising Covid-19 vaccine

The S&P 500 and Dow Jones industrial average notched record closing highs on Monday as news of another promising coronavirus vaccine fanned hopes of eradicating Covid-19, while spiking infections and new shutdowns threatened to hobble a recovery from the pandemic recession.

-

Tuesday, November 10th 2020 - 09:39 UTC

US markets react strongly to president-elect Biden's announcement and Pfizer vaccines results

The S&P 500 ended higher but closed just shy of a record on Monday as investors bet that a full economic reopening was finally in sight following the first positive data from a late-stage Covid-19 vaccine trial.

-

Wednesday, April 1st 2020 - 07:45 UTC

Wall Street markets tumbled on Tuesday: Dow with its biggest quarterly decline since 1987

Wall Street’s three major indexes tumbled on Tuesday, with the Dow registering its biggest quarterly decline since 1987 and the S&P 500 suffering its deepest quarterly drop since the financial crisis on growing evidence of massive economic damage from the coronavirus pandemic.

-

Friday, January 17th 2020 - 10:29 UTC

Wall Street stocks at fresh records after approval of North American trade pact

Wall Street stocks surged to fresh records on Thursday after the US Senate approved a new North American trade pact, adding to the momentum from the US-China trade deal. All three major indices finished at all-time highs, with the Dow Jones Industrial Average up 267.42 points (0.92%) at 29,297.64.

-

Thursday, January 16th 2020 - 08:54 UTC

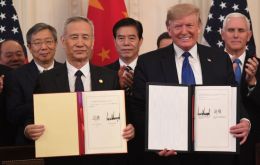

World stocks at record high after US and China sign a deal to defuse the trade war

World stocks inched to a record high on Thursday after the United States and China signed a deal to defuse their 18-month trade war, which has weighed on global economic growth and hampered investments.

-

Tuesday, December 24th 2019 - 08:53 UTC

Wall Street stocks Xmas records: Dow Jones Industrial Average reached 28,551.53

Wall Street stocks finished at records again on Monday, with an executive shakeup at Boeing lifting the Dow, as a holiday-shortened week opened with a flourish. The Dow Jones Industrial Average climbed 96.44 points (0.34 percent) to finish the last full session before Christmas at 28,551.53.

-

Saturday, January 5th 2019 - 08:34 UTC

US economy ever so strong: 312.000 jobs added in December

The US economy created many more jobs than expected in December, according to the latest government data. Employers added 312,000 jobs, far ahead of predictions of 177,000, the Labor Department said.

-

Thursday, October 11th 2018 - 09:08 UTC

US markets suffer their sharpest one-day fall: fears of interest rates, inflation and trade tensions

United States share markets suffered on Wednesday their sharpest one-day falls in months, as fears about rising interest rates, inflation, trade tensions intensified. The tech-heavy Nasdaq led the declines, sliding 4%, or 315.9 points, to 7,422. The Dow Jones and S&P 500 also fell by more than 3%, with losses accelerating towards the end of the day. Netflix fell 8%, while Amazon slid 6%.