MercoPress. South Atlantic News Agency

Tag: oil

-

Saturday, May 2nd 2020 - 07:20 UTC

Shell announced it was cutting its dividend for the first time since World War Two

Royal Dutch Shell cut its dividend for the first time since World War Two on Thursday as the energy company retrenched in the face of an unprecedented drop in oil demand due to the coronavirus pandemic.

-

Thursday, April 30th 2020 - 08:39 UTC

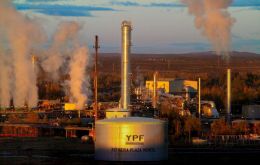

Argentina refineries running at minimum capacity because of lack of demand

A Buenos Aires crude oil refinery operated by Argentine state-controlled energy firm YPF is running with a minimal level of workers due to a drop in consumption and a lack of storage space amid a crash in global oil prices during the coronavirus pandemic, a spokesman said on Wednesday.

-

Friday, April 24th 2020 - 08:25 UTC

With oil royalties plummeting, Rio state challenged by investment funds

Already grappling with one of Brazil’s most severe outbreaks of the novel coronavirus and a budget deep in the red, Rio de Janeiro state faces a potential threat to its solvency at the hands of investment giants PIMCO and Dodge & Cox.

-

Wednesday, April 22nd 2020 - 08:56 UTC

Trump orders a plan to aid US struggling oil companies with massive supply glut

President Donald Trump on Tuesday ordered his administration to come up with a plan to aid US oil companies struggling with a massive supply glut and record low crude prices. “We will never let the great U.S. Oil & Gas Industry down,” Trump tweeted.

-

Tuesday, April 21st 2020 - 10:16 UTC

US oil price on Monday turned negative for the first time in history

The price of US oil has turned negative for the first time in history. That means oil producers are paying buyers to take the commodity off their hands over fears that storage capacity could run out in May.

-

Monday, April 20th 2020 - 07:39 UTC

US oil falls to below US$ 15 a barrel and Brent dropped to US$ 27

US crude fell about 20% to below US$15 a barrel on Monday, its lowest level in about two decades, as a coronavirus-triggered collapse in demand eclipsed a deal to cut output. West Texas Intermediate, the US benchmark, fell 18.7% to US$14.84 a barrel. Brent crude, the international benchmark, was off 1.5% at US$27.64 a barrel.

-

Tuesday, April 14th 2020 - 07:48 UTC

Exxon raises US$ 9,5bn to bolster its finances; shares have lost 38%

Exxon Mobil Corp on Monday raised US$ 9.5 billion in new debt, with the largest U.S. oil producer seeking to bolster its finances while debt markets remain open to new deals.

-

Monday, April 13th 2020 - 10:54 UTC

Oil prices recover modestly following a historic deal by world's largest producers

Oil prices jumped on Monday after swinging wildly in early trading as investors weighed whether a historic deal by the world’s biggest producers to cut output would be enough to steady a market pummeled by the coronavirus.

-

Monday, April 13th 2020 - 10:15 UTC

Mexico has its oil protected by a sovereign hedge ensuring against low prices

While Mexico and Saudi Arabia fought over a deal to bring the oil-price war to an end, Mexico has a powerful defense: a massive Wall Street hedge shielding it from low prices. The Mexican sovereign oil hedge, which ensures the country against low prices and is considered a state secret, is a factor that may make the country less inclined to accept the OPEC+ agreement.

-

Saturday, April 11th 2020 - 10:18 UTC

YPF slashes oil production 50% as consumption slumps and depots are overflowing

Argentina’s state-held energy firm YPF slashed by 50% the oil production from its key development area in the vast Vaca Muerta shale play this week due to tumbling fuel demand in Argentina’s lockdown, local news outlet Rio Negro reports.