MercoPress. South Atlantic News Agency

Tag: Open, Simultanous and Compulsary Primary elections (PASO)

-

Monday, October 7th 2019 - 09:55 UTC

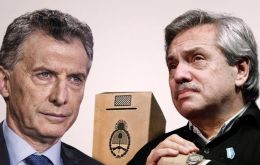

Opinion Polls in Argentina indicate Fernandez will be the next president

Caution minded since Argentine public opinion polls were so far off the mark during the August Primary mandatory elections which triggered the current major political and financial upheaval in the country...

-

Tuesday, October 1st 2019 - 09:59 UTC

Some 15.8 million Argentines living in poverty according to the latest data

Poverty in Argentina rose to 35.4% of the population in the first half of the year, the highest officially recorded level since 2001, the INDEC national statistics bureau reported today. This means that some 15.8 million Argentines are now considered poor, INDEC's data indicates. At the end of 2018, 32% of Argentines were said to be living in poverty.

-

Monday, September 30th 2019 - 06:41 UTC

Argentine ruling coalition wins election in Mendoza, but keeps Macri well away

The province of Mendoza has delivered to the Argentine ruling coalition of president Mauricio Macri a much needed great stimulus with its landslide governorship victory.

-

Thursday, September 26th 2019 - 09:56 UTC

Resumption of Argentina's financial program with IMF frozen... and “will have to wait”

Argentina’s financial program with the International Monetary Fund (IMF) will be on hold for some time as the nation grapples with severe political and economic uncertainty, the Fund’s Acting Managing Director David Lipton said an interview.

-

Monday, September 16th 2019 - 09:47 UTC

IMF choice: to unlock or not to unlock the last tranche of funds for Argentina

The International Monetary Fund has a tough choice to make in Argentina: unlock US$5.4 billion in funds under the country’s loan deal as the government strains to stave off default, or hold the money back and risk sparking more market panic.

-

Tuesday, August 27th 2019 - 10:56 UTC

Argentines fear of a repeat of the “corralitos” of 1989 and 2002

It happened in 1989. It happened in 2002. Argentines who are old enough to remember do not want to go through it again.

-

Thursday, August 22nd 2019 - 09:55 UTC

Argentina default “possible”, but not “probable”, says credit rating agency Fitch

Argentina could be downgraded again by Fitch Ratings if further weakness in the Peso boosts the risk of default, the agency’s head of sovereign ratings said in an interview. Argentina has issued billions of dollars worth of bonds denominated in U.S. currency.

-

Tuesday, August 20th 2019 - 07:40 UTC

Francis involvement in Argentine politics, is “an idea belonging to science fiction”

A bishop had denied point-blank any involvement of Pope Francis in Argentine politics, following on August 11 presidential primaries, which have quashed President Mauricio Macri's reelection aspirations, increasing opposition candidate Alberto Fernandez chances of taking office next 10 December, while Latin America's third economy was driven into financial chaos as the word default creeps intensely as a possibility in the near future.

-

Saturday, August 17th 2019 - 08:53 UTC

Fitch downgrades Argentina's long term debt, fearing the risk of default

Argentina's Peso ended a tumultuous week on Friday having shed 20% in its value against the dollar as Fitch cut the South American country's long-term debt by two notches, citing increased uncertainty and a rising risk of default.

-

Friday, August 16th 2019 - 07:53 UTC

Dollar volatility in Argentina eases in line with political dialogue

Argentine markets bucked the dismal three-day losing streak on Thursday, amid signs of political compromise and a new central bank measure to prop up the embattled currency.