MercoPress. South Atlantic News Agency

Tag: Organization of the Petroleum Exporting Countries OPEC

-

Tuesday, September 10th 2024 - 08:12 UTC

Morgan Stanley, Goldman Sachs, Citi forecast oil price falling in Q4 and 2025

Investment bank Morgan Stanley has again cut its forecast price for a barrel of oil, expecting the international benchmark to average US$ 75 a barrel in the last quarter of the year. This is because analysts at Morgan Stanley see rising headwinds on the demand side, which has been their key reason for cutting their Q4 oil price forecast.

-

Friday, December 1st 2023 - 22:45 UTC

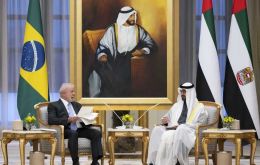

Brazil joining OPEC+ as of next year

Effective Jan. 1, 2024, South America's largest country will join the Organization of Petroleum Exporting Countries (OPEC), Brazil's Minister of Mines and Energy Alexandre Silveira announced this week after participating virtually in a meeting with other colleagues from the bloc.

-

Monday, April 3rd 2023 - 09:42 UTC

OPEC+ countries announce cut in output to keep price stable

Oil-producing countries grouped under OPEC+ Sunday announced a voluntary cut in crude output of around 1.15 million barrels per day (bpd) in addition to a 2-million reduction agreed upon in October to boost prices, it was reported. The measure will come into effect in May and last until the end of this year.

-

Thursday, December 12th 2019 - 17:47 UTC

Venezuela increases oil output amid drive to keep world inventories low

OPEC Wednesday announced that oil pumping in Venezuela in November reached 697.000 bpd. But one country's increase in production may not have a positive impact in the near future in view of OPEC's decision to curb output in an attempt to keep inventories at a level that holds profit margins attractive.

-

Tuesday, April 23rd 2019 - 09:00 UTC

US threatens sanctions on countries that continue to purchase Iranian oil: crude hits six month highs

The United States on Monday demanded that buyers of Iranian oil stop purchases by May 1 or face sanctions, a move to choke off Tehran's oil revenues which sent crude prices to six-month highs on fears of a potential supply crunch.

-

Monday, December 3rd 2018 - 07:18 UTC

Oil prices recover following on US/China trade conflict 90-day truce

Oil prices surged in early trading on Monday after the United States and China agreed on a truce in their trade conflict and ahead of a meeting by producer club OPEC this week that is expected to result in a supply cut.

-

Monday, November 12th 2018 - 18:13 UTC

Oil producing countries agree on need to cut down crude output due to oversupply

They call it “production adjustments,” but in reality most major oil extracting countries agreed Sunday new strategies regarding crude output were needed in light of the surplus accrued over the past few months.

-

Thursday, November 8th 2018 - 07:34 UTC

US oil output hits another record, but prices and world market remain volatile

Oil prices slipped on Wednesday, continuing a recent slide after surging U.S. crude output hit another record and domestic inventories rose more than expected. The U.S. Energy Information Administration (EIA) said domestic crude inventories rose 5.8 million barrels in the latest week, more than double analysts’ expectations.

-

Tuesday, September 25th 2018 - 07:45 UTC

Oil market turbulence ahead of US sanctions on Iran; OPEC meeting does not plan to increase output

Brent crude breached US$ 81 a barrel on Monday — its highest level in nearly four years — on the back of a tightening oil market and OPEC leaders signaling they won't be immediately boosting output. Global benchmark Brent crude rose as high as US$ 81.39 a barrel, its strongest level since Nov. 21, 2014.

-

Wednesday, November 8th 2017 - 10:50 UTC

Oil markets settle lower, but prospects are in place for prices to continue climbing

Oil settled lower on Tuesday after rising to the highest since July 2015 the previous day, while tension flared between Saudi Arabia and Iran, and the Saudi crown prince tightened his grip on power.