MercoPress. South Atlantic News Agency

Stories for April 2012

-

Wednesday, April 11th 2012 - 06:38 UTC

Paraguayan economy forecasted to suffer a strong contraction this year

The economy of Mercosur junior member Paraguay, is set to remain flat or even suffer a slight contraction in 2012 after several years of sustained growth announced on Tuesday the country’s central bank.

-

Wednesday, April 11th 2012 - 06:35 UTC

A possible Chinese exit for the ongoing clashes between Repsol YPF and Argentina

China National Offshore Oil Corporation, CNOOC, could prove to be the solution for the ongoing clash between the Argentine government and Spain’s Repsol which holds a majority stake in YPG, Argentina’s main oil and gas company.

-

Wednesday, April 11th 2012 - 06:33 UTC

Petrobras and Argentine government reach tentative agreement to increase investments

The escalade between the Argentine government and the oil companies seems to have cooled off for a few hours on Tuesday following a meeting of Planning Minister Julio De Vido with top officials from Petrobras Argentina, and which was described as ‘productive’.

-

Wednesday, April 11th 2012 - 02:13 UTC

Half a million Argentine tourists ‘invaded’ Chile during the first quarter of 2012

In the first quarter of this year, 1.2 million foreign tourists arrived in Chile, which represents a 14% increase over the same period a year ago, reported the Under Secretary of Tourism Jacqueline Plass.

-

Wednesday, April 11th 2012 - 02:09 UTC

Bolivia rescinds contract to build road through Amazon Indian reservation

Bolivian President Evo Morales says he is rescinding the contract of a Brazilian firm to build a controversial road through the Amazon rainforest. He accused the firm, OAS, of not complying with the terms of the deal.

-

Wednesday, April 11th 2012 - 02:06 UTC

Brazil will bring up Europe poultry-meat subsidies at next Mercosur/EU trade round

Brazil has given a clear indication of its intention to attack European export subsidies for poultry-meat the next time Mercosur and the EU meet to discuss a possible cooperation and trade agreement.

-

Wednesday, April 11th 2012 - 02:03 UTC

Colombia anticipates no Falklands mention in the Americas summit final statement

The coming 6th Summit of the Americas will not include in its final statement the issue of the Falkland/Malvinas Islands, the sovereignty of which is in dispute between Argentina and the UK.

-

Wednesday, April 11th 2012 - 00:38 UTC

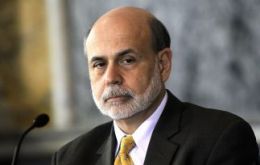

Bernanke says more bank regulation is needed to ensure stable financial system

US Federal Reserve Chairman Ben Bernanke said banks need to have more capital at hand in order to ensure the financial system is stable. Bernanke said regulators were taking steps to force financial institutions to hold higher capital buffers, even if they allow for a long period of implementation to prevent any market disruptions.

-

Wednesday, April 11th 2012 - 00:35 UTC

UK confirms it claims repayment of £ 45m loaned to Argentine Junta that invaded the Falklands

The UK is seeking repayment of a loan granted to Argentina in 1979 which was invested in military procurement some of which was used during the Falkland Islands conflict.

-

Wednesday, April 11th 2012 - 00:30 UTC

IMF analyzes impact of household debt and soaring house prices on recessions

Housing busts and recessions are more severe and last for at least five years when they follow a big run-up in household debt, according to a study released by the International Monetary Fund. For that matter, the IMF has urged governments to consider “bold” interventions to reduce household debt levels and stimulate growth.