MercoPress. South Atlantic News Agency

Maduro announces 20bn dollars in investment credits from China

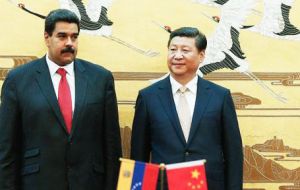

The Venezuela leader made the statements from Beijing after holding a meeting with Chinese President Xi Jinping.

The Venezuela leader made the statements from Beijing after holding a meeting with Chinese President Xi Jinping.  Venezuela is desperate for hard currency in the face of a recession, the highest inflation in the Americas, and falling oil prices.

Venezuela is desperate for hard currency in the face of a recession, the highest inflation in the Americas, and falling oil prices. President Nicolas Maduro said on Wednesday he had secured a total of more than 20 billion dollars in investment from major creditor China for economic, social, and oil-related projects.

It was unclear if part of the announced investments include new loans for the cash-strapped OPEC member, or if the investments were part of an existing oil-for-loans deal between Venezuela and China.

“We have wrapped up over 20 billion in investments during the course of this day's work,” Maduro said in comments from Beijing broadcast on Venezuelan state television after a meeting with Chinese President Xi Jinping.

Venezuela is desperate for hard currency in the face of a recession, the highest inflation in the Americas, and falling oil prices. China has already provided billions of dollars in loans that are repaid through oil and fuel shipments.

Maduro also said Venezuela was strengthening ties with Chinese banks and that financing for development, the Chinese-Venezuelan fund, the Large Volume fund and “other mechanisms” were set to be approved in the first half of the year, without providing further details.

He said China would also increase its stakes and investments in the Venezuela's oil sector and the Orinoco oil belt, but did not provide further information on that either.

Urging unity within OPEC and cooperation with non-OPEC nations such as Russia and Mexico, Maduro repeated earlier statements that he believed oil prices would rebound “sooner or later.”

Increased funds would likely improve Venezuela's cash flow this year, when state spending is likely to increase in the run-up to parliamentary elections.

That said, economists are urging far deeper changes to end the crisis, including unifying Venezuela's Byzantine currency controls and increasing the price of what is the world's cheapest gasoline.

Maduro has so far appeared unwilling to implement the crucial but unpopular measures, as his approval ratings drop.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsThe Chinese have made a “payday loan” that will cost Maduro a fortune in future obligations.

Jan 08th, 2015 - 12:04 pm 0So funny. A 'country' with the world's largest proven oil reserves has to go cap in hand to China for 'credits'. If Venezuelans can't see what an arse this proves MADurine to be, they deserve all they get. 30 million people who can't get someone intelligent to govern!

Jan 08th, 2015 - 12:25 pm 0“It was unclear if part of the announced investments could include new loans, or whether the investments were part of existing oil-for-loans deals between Venezuela and its major creditor China.”

Jan 08th, 2015 - 12:41 pm 0http://finance.yahoo.com/news/venezuelas-maduro-says-secures-over-183841330.html

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!