MercoPress. South Atlantic News Agency

Economy

-

Monday, June 16th 2014 - 00:35 UTC

Argentina's inflation index in May, 1.4% and 13.5% in five months

Argentina's consumer price index revealed an inflation rate of 1.4% for May, down from 1.8% in the previous month announced on Friday Economy Minister Axel Kicillof at a press conference held at the Ministry in Buenos Aires. In the first five months of the year inflation stands at 13.5%.

-

Sunday, June 15th 2014 - 12:20 UTC

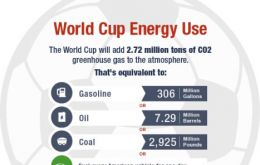

How Much Energy Will the 2014 World Cup Consume?

Along with 3 billion other viewers around the world, I plan to tune in for the month-long World Cup to see whether the 22-year old Neymar can withstand the colossal pressure that has been put upon his shoulders to deliver a win for team Brazil.

-

Saturday, June 14th 2014 - 09:29 UTC

Argentina on the war path against Uruguay following re-ignition of pulp mill dispute

Argentina reacted strongly and with a letter in harsh terms to Uruguay's decision to authorize Finland's UPM-Kymmene pulp mill to increase annual production by 8%. The letter addressed by Foreign minister Hector Timerman to his peer Luis Almagro informs Argentina will take the case to international tribunals and is currently 'reassessing' bilateral relations.

-

Friday, June 13th 2014 - 08:26 UTC

US Supreme Court decision of Argentina/hedge funds case delayed until Monday

The US Supreme Court will reveal its decision on Argentina's request regarding litigation with the hedge funds case on Monday at 10.30am, after deliberating on Friday behind closed doors. A final outcome could arrive as late as next year though, if the judges decide to ask the US government for an opinion on the case before ruling.

-

Friday, June 13th 2014 - 07:32 UTC

Easy-monetary policy advocates join the Federal Reserve; Fischer confirmed vice-chairman

The US Senate confirmed on Thursday Stanley Fischer to be vice chairman of the Federal Reserve and approved Jerome Powell and Lael Brainard as members of the central bank's board, bolstering the Fed as it prepares to wind down its extraordinary stimulus.

-

Friday, June 13th 2014 - 07:02 UTC

Gibraltar to experiment with a wave-power alternative energy project

The Government of Gibraltar has signed its first power purchase agreement for the provision of renewable energy. The agreement, which is with Eco Wave Power, is for the provision of an initial 0.5MW energy device on the eastside of the Rock.

-

Thursday, June 12th 2014 - 07:39 UTC

Beijing hosts this year's Meat Congress; China has become Uruguay's main beef client

China will be holding this year's World Meat Congress in Beijing, an event traditionally hosted by meat producing and exporting countries. However the significance of the world's second largest economy and its booming demand for meat have made it the right place for the 14/16 June conference.

-

Thursday, June 12th 2014 - 07:18 UTC

World Bank lowers global economy growth forecast; developing countries face major challenge

World Bank lowered its 2014 growth forecasts for the global economy but said advanced economies' rebound from a rough start would help offset stagnation in developing countries. Most of the pick-up in growth this year will come from high-income countries, particularly the United States and the 18-nation Euro zone, the World Bank said in its twice-yearly Global Economic Prospects report.

-

Thursday, June 12th 2014 - 07:06 UTC

Argentina's 'Congressional inflation index' in May, 2.28% and 39.9% in twelve months

Inflation in Argentina during the month of May reached 2.28% and 39.9% in the last twelve months according to the so called 'Congressional index' which is released by opposition lawmakers from the Freedom of Expression committee.

-

Thursday, June 12th 2014 - 07:01 UTC

Poor performance of Argentina's industrial production during April

According to the Argentine Industrial Union (UIA), industrial production in the country fell 3.4% in April compared to the same month of 2013. Considering the first four months of 2014, the industry dropped 2.2% versus the same period last year.