MercoPress. South Atlantic News Agency

Economy

-

Tuesday, September 10th 2019 - 09:54 UTC

Argentine gross public debt stands at US$ 337.367 million; 2020 repayments sum US$ 44.232 million

Argentine gross public debt climbed 3% at the end of the second quarter of the year and has reached US$ 337.367 million compared to US$ 327.166 million in the same period last year, according to the Financial Secretariat.

-

Tuesday, September 10th 2019 - 09:50 UTC

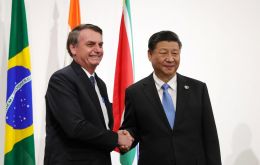

Brazil and China closer: Bolsonaro visits Beijing in October and Xi travels to Brasilia in November

Brazil’s Vice President Hamilton Mourao said on Monday that Chinese President Xi Jinping will visit Brazil in November, as the two nations seek to strengthen political and economic ties at a time of global trade tensions.

-

Tuesday, September 10th 2019 - 09:50 UTC

August inflation in Brazil below target, with room for further rate cuts

Consumer price inflation in Brazil was well contained in August, as forecast, reinforcing expectations of deeper interest rate cuts by the central bank as it tries to fire up economic growth.

-

Tuesday, September 10th 2019 - 09:16 UTC

Another lady, Kristalina Georgieva, will become the IMF managing director

The top executive at the World Bank, Kristalina Georgieva of Bulgaria, now faces no opposition in her candidacy to lead the International Monetary Fund, the fund announced on Monday.

-

Tuesday, September 10th 2019 - 09:00 UTC

House speaker makes it official: Berkow stepping down after ten years on Oct. 31

John Bercow, the speaker of Britain's House of Commons, officially announced on Monday that he would step down within weeks, amid criticism by Brexit hardliners who say he has twisted parliamentary rules to undermine them.

-

Monday, September 9th 2019 - 09:58 UTC

Argentine presidential candidate proposes “a national unity government”: 'option can't be bad or worse'

Argentine presidential candidate and ex Economy minister Roberto Lavagna said that the country needs “a national unity government” to overcome the current situation and it's no option having to choose between “bad and worse”.

-

Monday, September 9th 2019 - 09:57 UTC

Another week of uncertainties begins in Argentine markets

Another volatile week with still many uncertainties begins this Monday for Argentina even when some of the latest measures adopted by the administration of President Mauricio Macri helped to calm markets, debilitating apocalyptic forecasts.

-

Monday, September 9th 2019 - 09:45 UTC

OPEC+ wants to further cut output to support oil price, but admits it no longer controls the market

Top oil producers will consider fresh output cuts at a meeting this week, but analysts are doubtful they will succeed in bolstering crude prices dented by the US-China trade war.

-

Monday, September 9th 2019 - 09:25 UTC

London losing ground in shipping services, says PwC report for Maritime London pointing to Brexit and taxes

Britain's position as a top hub for maritime services is being eroded by competition, a loss of shipping finance business and the removal of tycoon-friendly tax breaks, a report said, deepening uncertainty for its financial sector as Brexit nears.

-

Monday, September 9th 2019 - 09:16 UTC

China beginning to feel the pinch of the trade war with US

China's exports fell by 1.0 per cent on-year in August, official data showed Sunday amid a bruising trade war with the US that has roiled markets in the world's top two economies. The drop comes after a surprise 3.3% rebound in July despite the yearlong battle with Washington and weakening global demand.