MercoPress. South Atlantic News Agency

Tag: Daniel Pollack

-

Saturday, August 9th 2014 - 07:34 UTC

Griesa warns Argentina with 'contempt' if it continues with “false and deceiving statements”

New York district judge Thomas Griesa on Friday threatened to declare Argentina in “contempt” of court if the Republic continues to make “false and deceiving statements,” following Argentina’s claim it has already paid exchange bondholders and has no pending obligations, as it deposited 539 million dollars in bond payments in Bank of New York Mellon (BoNY) and Citibank.

-

Wednesday, August 6th 2014 - 08:02 UTC

Argentina will demand Citibank and BONY to pay exchange bondholders

The Argentine Government will formally demand that Citibank and the Bank of New York Mellon pay exchange bondholders, the Economy Ministry informed on Tuesday in a press release.

-

Tuesday, August 5th 2014 - 07:14 UTC

Argentina planning to question Judge Griesa before the International Court of Justice

Argentina's Legal and Technical Secretary to the Presidency Carlos Zannini is overseeing a group of experts in international law as they draft the suit the government of President Cristina Fernandez will file against US Judge Thomas Griesa’s ruling on full repayment to holdout bondholders at International Court of Justice in the Hague, according to Noticias Argentinas-

-

Tuesday, August 5th 2014 - 06:54 UTC

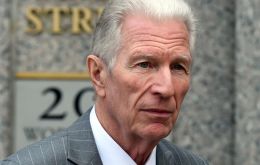

Griesa praises Pollack's 'great skill” and reveals he directed the use of 'default'

U.S. District Judge Thomas Griesa on Monday turned back an effort by Argentina's government to remove the court-appointed mediator in the dispute with creditors that triggered a 'selective default' situation by the country last week. He also revealed that the default condition was at his direction and was 'accurate'.

-

Saturday, August 2nd 2014 - 08:58 UTC

Argentina suggests Griesa and Pollack are actively helping holdouts by declaring a 'default'

The Argentine Economy Ministry claimed on Friday New York judge Thomas Griesa has benefited “vulture funds” during negotiations over Argentina's defaulted debt with holdouts and asked the (Argentine) National Values Commission (CNV) to start an investigation over alleged “speculative moves”.

-

Saturday, August 2nd 2014 - 04:08 UTC

Griesa orders Argentina/holdouts to resume negotiations and an end to 'misleading information'

US District Judge Thomas Griesa presiding over Argentina's bitter dispute with two hedge funds left the country stranded in default on Friday, ordering it to hold new negotiations and calling for an end to “mistrust”. In a stern tone Griesa slammed the decision by Argentina to defy his order that it pay in full holdout investors and instead opted to default on 29 billion dollars in debt.

-

Friday, August 1st 2014 - 02:43 UTC

Saying Argentina has defaulted is “an atomic nonsense” underlines Kicillof

Argentina's Economy Minister Axel Kicillof denied point blank that Argentina defaulted on its debt and described such statement as “an atomic nonsense”. The minister gave a press conference in Buenos Aires a day after the failed negotiations with holdouts in New York and claimed ”those who today cheer the apocalypse, applauded the 2001 (crisis).”

-

Thursday, July 31st 2014 - 07:05 UTC

Kicillof blames Judge Griesa for the 'no-deal' situation with holdouts

Argentina failed to strike a deal to avert its second default in more than 12 years after talks with holdout creditors and special mediator Daniel Pollack ended without a settlement on Wednesday.

-

Thursday, July 31st 2014 - 06:55 UTC

Argentine private banks discussing bond purchase from holdouts

The meeting between Argentine private bank representatives and the 'holdouts' over the debt held by the hedge funds has been adjourned and will be resumed on Thursday, according to Buenos Aires financial daily Ambito.com.

-

Thursday, July 31st 2014 - 01:15 UTC

“Argentina will imminently be in default: no agreement was reached”, said Pollack

“Unfortunately no agreement was reached and Argentina will imminently be in default”, admitted Daniel A. Pollack, the Special Master appointed by Judge Thomas P. Griesa to conduct and preside over settlement negotiations between Argentina and its holdout bondholders. Pollack emphasized that with default “the ordinary Argentine citizen will be the real and ultimate victim”.