MercoPress. South Atlantic News Agency

Tag: Merval stock index

-

Friday, August 16th 2019 - 07:53 UTC

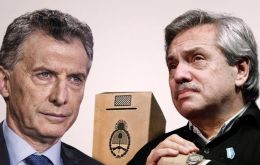

Dollar volatility in Argentina eases in line with political dialogue

Argentine markets bucked the dismal three-day losing streak on Thursday, amid signs of political compromise and a new central bank measure to prop up the embattled currency.

-

Tuesday, April 9th 2019 - 09:59 UTC

Argentina's Peso takes a rest after a hectic week but the country risk shoots to its highest this year

Latin American stocks were flat on Monday, partly subdued by delays in important pension reform in Brazil, while currencies in the region rose against a weak dollar but Argentina's peso hovered around record-low levels on political uncertainty and the highest country risk so far this year.

-

Friday, September 28th 2018 - 08:58 UTC

Brazilian currency strengthens below 4 to the dollar: first time in five weeks

The Brazilian currency dipped under four Real to the dollar for the first time in five weeks at close on Thursday as the markets reacted favorably to the emergence of two clear presidential election frontrunners. The Real closed at 3.99 to the US dollar just two weeks after hitting a record low of almost 4.2 to the dollar -- it's lost around 17% since the start of the year.

-

Tuesday, September 25th 2018 - 06:59 UTC

“Zero chance” Argentina will default on its debt next year, Macri tells bankers and investors

President Mauricio Macri said on Monday that Argentina was close to a deal with the International Monetary Fund to bolster a US$ 50 billion credit line, while a government source said US$ 3-US$ 5 billion in additional funds could be announced this week.

-

Tuesday, September 11th 2018 - 09:12 UTC

Argentine equities and Peso lose ground on Monday: IMF and budget concerns

Argentine equities and the peso both lost ground on Monday as analysts said intervention in the foreign exchange market by the nation's central bank may prove less successful than originally hoped.

-

Friday, September 7th 2018 - 09:18 UTC

IMF wants to wrap up talks to financially support Argentina “as rapidly as possible”

The International Monetary Fund said on Thursday it aimed to wrap up talks to “strengthen” a US$ 50 billion backup financing deal with Argentina “as rapidly as possible,” as the country's peso and stocks climbed for a second straight day.

-

Friday, August 31st 2018 - 08:06 UTC

Bargain shopping for oil companies in Buenos Aires stock market

While the foreign exchange market in Argentina experienced a chaotic Thursday with no ceiling for the US dollar as locals dumped their Argentine pesos, the Argentine stock market witnessed another strong increase with the Merval index up 5.3% reaching 26.754,85 points, boosted mainly by the oil industry stocks.

-

Sunday, August 26th 2018 - 04:35 UTC

Argentina's Peso falls 1.42% on Friday, despite a weaker dollar following Fed's Powell speech

Argentina’s peso currency fell 1.42% to a record low close of 30.92 per dollar on Friday, weighed down by an economy slipping into recession, high inflation and uncertainty driven by corruption investigations.

-

Thursday, July 19th 2018 - 07:50 UTC

Brazilian Real and Argentine Peso lose ground against the dollar

Latin American currencies fell against the dollar across the board on Wednesday as traders continued to focus on recent statements by key U.S. monetary policy makers.

-

Thursday, June 28th 2018 - 11:57 UTC

Black Wednesday for Argentina and Brazil as selloff intensifies across emerging markets assets

Argentina’s benchmark MerVal stock index closed down 8.8% on Wednesday, its worst daily performance since early 2014, as concerns about trade tensions between the United States and China prompted a selloff across emerging market assets.