MercoPress. South Atlantic News Agency

Tag: US Supreme Court

-

Monday, June 23rd 2014 - 04:27 UTC

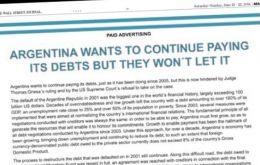

Argentina takes its differences with Judge Griesa to the US main journals

Argentina on Sunday took its battle against paying hedge fund investors in its defaulted bonds to the US media, placing adverts in major newspapers demanding US courts help foster “fair and balanced” negotiations.

-

Monday, June 23rd 2014 - 04:08 UTC

Jubilee Debt Campaign supports Argentina against “vulture funds” quick bucks

The following letter under the heading of “Urgent need for legislation on Argentina debt” was published in the Financial Times and refers to the ongoing battle with the holdout hedge funds.The piece is signed by Tim Jones, Policy Officer, Jubilee Debt Campaign, London, N1, UK.

-

Saturday, June 21st 2014 - 09:45 UTC

Strong warning to Argentina from Griesa regarding payment of bondholders

US Federal Judge Thomas Griesa, ratified on Friday through an official letter that Argentina’s proposal to carry out a debt exchange and pay its bondholders in Buenos Aires represents a “violation of the rulings and procedures.”

-

Friday, June 20th 2014 - 07:21 UTC

After all: Argentina seems willing to start discussions with Griesa and hedge funds

After a day of fury and discussions with cabinet members, advisors and experts, Argentine president Cristina Fernandez will be sending a government delegation to New York to meet Judge Thomas Griesa and the hedge funds holdouts' solicitors and begin, hopefully, a round of negotiations to reach a settlement on the bonds litigation.

-

Friday, June 20th 2014 - 06:42 UTC

Argentina's Supreme Court loss may serve as a wake-up call

The following piece by Charles Lane published in the The Washington Post offers an interesting debate about future bailouts and sovereign debt restructuring, following on Argentina's case.

-

Thursday, June 19th 2014 - 02:26 UTC

Griesa does not trust Cristina Fernandez and condemns the word “extortionist”

US Judge Tomas Griesa said on Wednesday that the televised speech delivered by President Cristina Fernández on Monday after the US Supreme Court declined to hear an appeal by Argentina in its battle against the holdouts was “a problem” for negotiations and implied he did not trust the Argentine leader.

-

Wednesday, June 18th 2014 - 07:52 UTC

“Judge Griesa's message is reasonable and conciliatory” argues Lavagna

Argentina's former Economy Minister and architect of the 2005 rescheduling of defaulted debt, Roberto Lavagna called for “calm” and “seriousness” to rethink the country's legal strategy following the setback suffered on Monday when the US Supreme Court decided not to hear its appeal against holdout hedge funds.

-

Wednesday, June 18th 2014 - 07:45 UTC

IMF concerned about 'wider systemic implications' of the US Supreme Court decision on Argentina

The International Monetary Fund is “concerned about wider systemic implications” the ruling by the US Supreme Court could prompt following its decision not to consider Argentina’s appeal aimed at staving off a default.

-

Wednesday, June 18th 2014 - 07:37 UTC

Argentina plans to reopen debt swap program and will request to meet Griesa

Economy Minister Axel Kicillof has announced that the government plans to reopen the debt swap program in the hope of renegotiating bonds held by hedge funds, after the US Supreme Court declined to take Argentina's case against the so-called 'vulture funds'.

-

Tuesday, June 17th 2014 - 07:15 UTC

Argentina will pay 92% of restructured bonds, hopefully 100% of debt, but will not accept extortions

President Cristina Fernandez pledged on national television late Monday that Argentina will abide and honor its debts, the 92% of those who trusted in the country and hopefully the 100% of creditors, but will not accept 'extortions'.