MercoPress. South Atlantic News Agency

Tag: Vulture funds

-

Friday, August 1st 2014 - 02:43 UTC

Saying Argentina has defaulted is “an atomic nonsense” underlines Kicillof

Argentina's Economy Minister Axel Kicillof denied point blank that Argentina defaulted on its debt and described such statement as “an atomic nonsense”. The minister gave a press conference in Buenos Aires a day after the failed negotiations with holdouts in New York and claimed ”those who today cheer the apocalypse, applauded the 2001 (crisis).”

-

Thursday, July 31st 2014 - 07:05 UTC

Kicillof blames Judge Griesa for the 'no-deal' situation with holdouts

Argentina failed to strike a deal to avert its second default in more than 12 years after talks with holdout creditors and special mediator Daniel Pollack ended without a settlement on Wednesday.

-

Thursday, July 31st 2014 - 06:55 UTC

Argentine private banks discussing bond purchase from holdouts

The meeting between Argentine private bank representatives and the 'holdouts' over the debt held by the hedge funds has been adjourned and will be resumed on Thursday, according to Buenos Aires financial daily Ambito.com.

-

Thursday, July 31st 2014 - 01:15 UTC

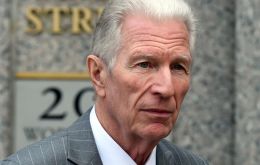

“Argentina will imminently be in default: no agreement was reached”, said Pollack

“Unfortunately no agreement was reached and Argentina will imminently be in default”, admitted Daniel A. Pollack, the Special Master appointed by Judge Thomas P. Griesa to conduct and preside over settlement negotiations between Argentina and its holdout bondholders. Pollack emphasized that with default “the ordinary Argentine citizen will be the real and ultimate victim”.

-

Tuesday, July 29th 2014 - 05:27 UTC

Griesa eases bond payments agenda; Argentina complies with the Paris Club

New York judge Thomas Griesa has confirmed that the Citigroup bank will on a one-off occasion be permitted to process payment on Argentine bonds held under Argentine law, which form part of the titles restructured following the default of 2001.

-

Wednesday, July 23rd 2014 - 06:51 UTC

Argentina claims Griesa is blocking bondholders money and using 'vulture funds' language

Argentina reacted strongly to Tuesday's events in the New York federal court which denied its stay request, claiming Judge Thomas Griesa “did not solve absolutely any of the issues for which he summoned today's audience”, insisting with his “unbelievable ban” on structured bonds' collecting their payment.

-

Thursday, July 17th 2014 - 07:14 UTC

CFK admits having to pay 300% profit on holdouts’ dollars, but never 1.680% as pretended

Argentine President Cristina Fernández rejected on Wednesday the possibility of a new default during the UNASUR-BRICS meeting in Brasilia, highlighting Argentina is going to “keep on paying and honoring its debt,” while asking for support against the “so called vulture funds,” who are “pretending to collapse the Argentine debt restructuring.”

-

Thursday, July 17th 2014 - 05:39 UTC

“K” economist claims holdout hedge funds are after Argentina’s shale resources

The holdout speculative funds or “vulture funds” are going after Argentina’s resource-rich Vaca Muerta region and are seeking to threaten the government with a “technical default” scenario, economist Agustín D’Atellis.

-

Wednesday, July 9th 2014 - 08:14 UTC

Mediator Pollack will receive Argentine delegation Friday in follow up meeting

Argentina confirmed on Tuesday that the delegation headed by Economy Minister Axel Kicillof will continue talks with mediation Daniel Pollack, next Friday in New York, a 'follow up' of Monday's first appointment.

-

Tuesday, July 8th 2014 - 08:20 UTC

Leading holdout hedge fund willing to give Argentina more time to negotiate

Elliott Management portfolio manager Jay Newman has revealed that the holdout hedge fund would be willing to give the Argentine government more time to negotiate following the nation's reverse in the US Supreme Court, while criticizing Economy minister Axel Kicillof for not meeting with the so-called 'vulture funds'.